Newsletter Performance Review : The Q4FY25 Reflection

Q4 Highlights : Exploring key business updates, Quarterly results & Growth Trajectories of featured companies - SGMart, India Shelter Housing Finance, P.N Gadgil, RBZ Jewellers & sathlokhar

The Q4FY25 Results Season is Behind Us: Time to Reflect & Review

As Q4FY25 results settle in, it’s a good time to pause and reflect. Since mid-November 2024, I’ve highlighted six companies, but with only 6-7 months passing, it’s tough to gauge the price performance accurately in such a short span.

The past few weeks have been particularly challenging for stock market investors. Since the first week of October, the market has faced significant turbulence:

The Broader index has plunged by 15- 30% & Recovering

As we navigate these turbulent times, it’s essential to revisit the companies covered in my previous newsletters and assess how they are weathering the storm. Let’s dive into the latest insights from these six companies in light of the broader market shifts.

1️⃣SGMART Ltd.

Good Results | Earnings call Summary | SGMART Original Newsletter | Investor PPT |

FY25 Revenue: ₹5,800 Cr | PAT: ₹103 Cr

Guidance Miss: Mgmt had earlier guided ₹7K–₹8K Cr revenue for FY25. They landed at ₹5.8K Cr. Main reason? Shift to royalty in TMT reduced reported topline despite stable volume.

TMT Business Shift , Big structural change in Q4: TMT moved to a royalty-based model → 43k tons sold in FY25, 30k in Q4 alone. Instead of gross billing, SG Mart earns royalty per ton—asset-light, high-margin, and WC-efficient.

why ?? Let's break it down There is a Change in Key Accounting Difference

Direct Sales (Old Model: "Billed through SG Mart")

In this setup: The entire sales value (say, ₹60,000 per ton) was recognized as revenue. • So, selling 43,000 tons could mean: 43,000 × ₹60,000 = ₹2,580 Mn added to topline revenue.

Topline is fully inflated by the gross value of sales.

Royalty-Based Model (New Model) Now, under the royalty model: • The company doesn’t sell the product. • It earns a fraction (a royalty fee), maybe something like ₹500 per ton. • For 43,000 tons, that’s: 43,000 × ₹500 = ₹21.5 Mn .

Topline only shows ₹21 Mn, not the full value of steel sold.

Key Accounting Difference:

1. Full sale value recognized, Topline appears higher

2. Royalty-Based Only royalty income recognized ,Topline appears lower.

Good Guidance from Management:

- FY26 EBITDA Target: ₹200 Cr

- FY27 EBITDA Target: ₹400 Cr

- Expect PAT to grow in line with EBITDA That’s a 2x YoY profit growth roadmap!

Service Centre Expansion Currently: 5 centres (Raipur, Pune, Ghaziabad, Bangalore, Dubai) Plan: Add 5 more (Jaipur, Kanpur, Patna, Siliguri, etc.)

Each can process 8k–10k tons/month = major volume/margin upside in FY26+

For a better understanding, Please read the full details of the concall summary by clicking Earnings call Summary below the stock name of each company.

2️⃣India Shelter Finance Corporation Ltd

Good Results | Original Newsletter | Earnings Summary

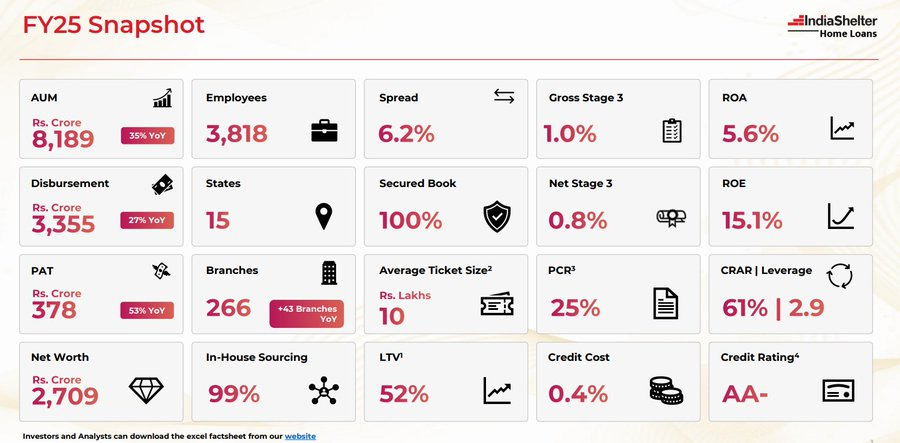

1. AUM Growth : AUM hit ₹8,189 Cr (35% YoY, 7% QoQ) — in line with guidance. Consistent loan book expansion driven by demand in Tier 2/3 markets

2. Disbursements : ₹933 Cr disbursed in Q4 FY25. FY25 total: ₹3,335 Cr (25% YoY) Steady loan pipeline + Direct sourcing model is paying off.

3. Q4 PAT : ₹108 Cr (+39% YoY) — first time crossing ₹100 Cr in a quarter.

FY25 PAT: ₹378 Cr (+53% YoY) .A sign of operational efficiency & scale kicking in.

Branch Strategy : Now at 266 branches, added 43 in FY25

Guidance: 40-45 more in FY26

More spread = less state concentration = De-risking play

Outlook & Ambition FY26 Growth guidance: → AUM +30-35%

Margins ~6% ; Credit cost 40-50 bps

Targeting ₹30,000 Cr AUM by FY30 Leverage to rise from ~2.9x → 4x (comfortably under cap)

3️⃣ P.N Gadgil Jewellers Ltd.

Good Results | Original Newsletter | Q4 Investor PPT | Q3 Earnings summary

Financial Performance : Q4 FY25 Revenue grew 5% YoY to ₹1,588.24 Cr While topline growth slowed to 5% YoY, it was a strategic slowdown.

Company exited its B2B refinery biz (low-margin, high-volume) - The B2B refinery sales were over 1,000-1100 Cr in FY24 and 700 crores in FY25, and will be zero in FY26

Retail-Led Growth Strategy Retail now contributes ~71% of revenue (vs. 60% in FY24) E-commerce revenue hit ₹90 Cr for FY25, up 243.7% YoY in Q4

Franchise segment grew 37.2% YoY in Q4.

FY26 Guidance Targeting 25–30% revenue growth

Volume growth aim: 8–11%

Retail margins targeted at 7–8%

Aggressive Store Expansion : Surpassed IPO promise: 17 new stores opened in FY25 .All new stores already profitable

FY26 Plan: 20–25 new stores

• 12–13 flagship PNG stores

• 12–13 “Lifestyle by PNG” — compact (1,500–2,000 sq ft), lightweight jewelry, Gen Z & impulse-buy focused Ownership: 50% franchise, 50% company-operated

Launch timing: Q1: 2–3 Lifestyle stores , Q2: 6–7 flagship stores Q3–Q4: 4–5 stores each Capex for Lifestyle stores capped at ₹8–9 Cr (Capex + store)

Break-even time for new stores :

- Maharashtra: 15–18 months

- Other states: 18–24 months

- Lifestyle: 12–15 months (Due to High Margin)

PAT margins expected in the range of 2.75%–3.25%, factoring expansion into unknown states outside Maharashtra, where break-even might take longer and costs could be higher.

4️⃣ RBZ Jewelers Ltd

Blockbuster Results | Earnings call summary | One Page Summary

Revenue up 59% YoY in Q4 FY25 to ₹137 Cr. FY25 closed on a strong note.

FY26 guidance: ₹700 Cr topline, ₹44-45 Cr PAT

FY27 target: ₹1000 Cr revenue / ₹55 Cr PAT – no deviation in plans

Retail expansion in full swing: Surat (Q3 FY26) & Rajkot (Q1 FY27) showrooms coming. Retail sales expected to touch ₹500 Cr in FY26, ₹600-700 Cr in FY27

B2B capacity steady – no capex needed - Same-store retail sales aiming for ₹400 Cr this year.

Walk-ins slowed but demand is "postponed, not denied"

Occasion wear (60–80% of sales) expected to bounce back in Q2/Q3

What happened in the internal fraud case?

An employee committed fraud – currently in police custody. Company has recovered much of the stolen gold. ₹25L provision made, full recovery expected. Internal controls & insurance response positive.

Is there a major GST/Tax issue pending?

The ₹25 Cr income tax notice (linked to bonus shares pre-IPO) is under appeal. Management calls it "baseless" and expects a favorable outcome by next quarter. No financial impact anticipated.

Unpacking the reasons behind the sharp correction Click Here . Stay tuned — follow on X for consistent market updates.

5️⃣Apollo Micro Systems

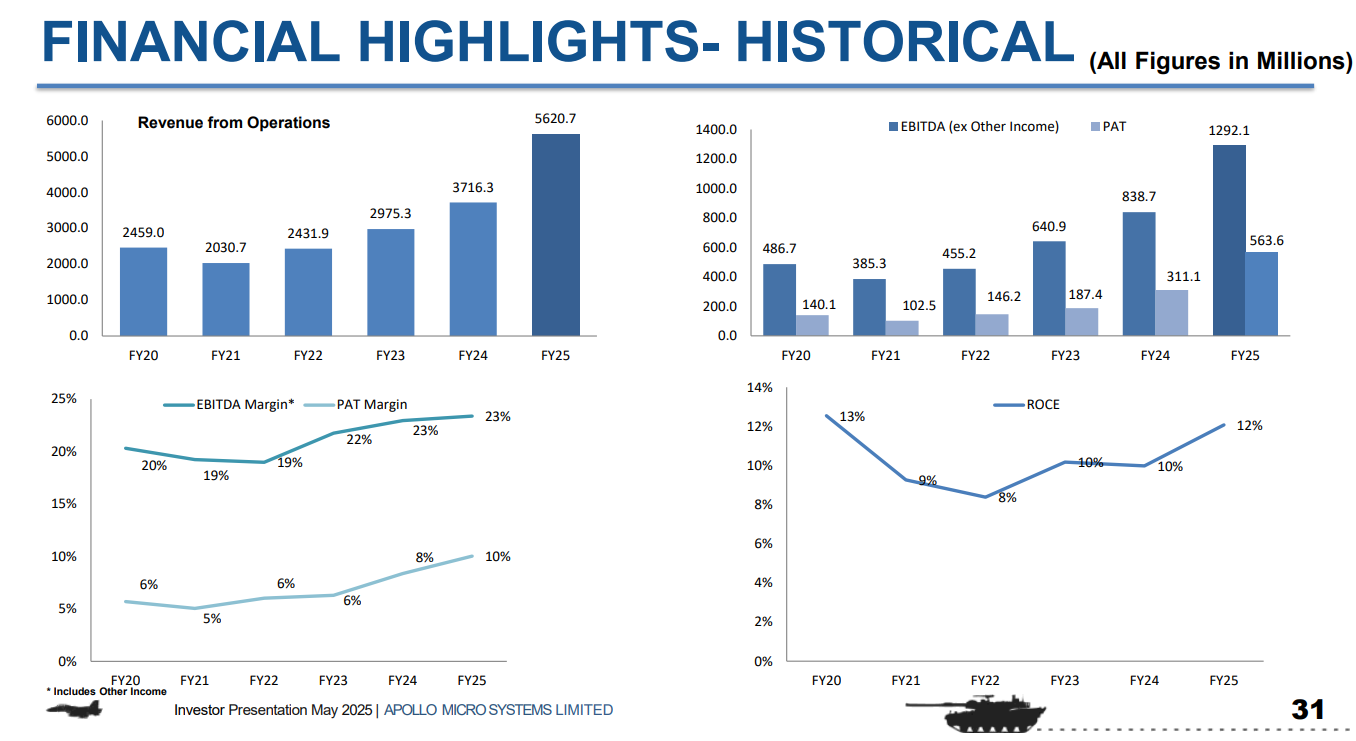

Revenue Performance: Consolidated revenue surged 51.3% YoY to ₹562.07 Cr, driven entirely by growth in the electromechanical components segment.

Profitability and EPS: Net profit jumped 81% to ₹56.36 Cr, with EPS rising to ₹1.86 from ₹1.24. Profit before tax doubled to ₹82.59 Cr. Margins improved despite rising input costs, supported by higher volumes and pricing power.

Management Guidance - - Revenue will be double in FY26 including IDL explosives and growing 45-50% CAGR in next 2 years on standalone basis. - EBITDA improvement; Better product mix and operating leverage

Exited this Company, Part of Portfolio Restructuring /some Juicy SME investment opportunities.

6️⃣ Sathlokhar Synergys E&C Global Limited

| Investor PPT | One Pager Summary

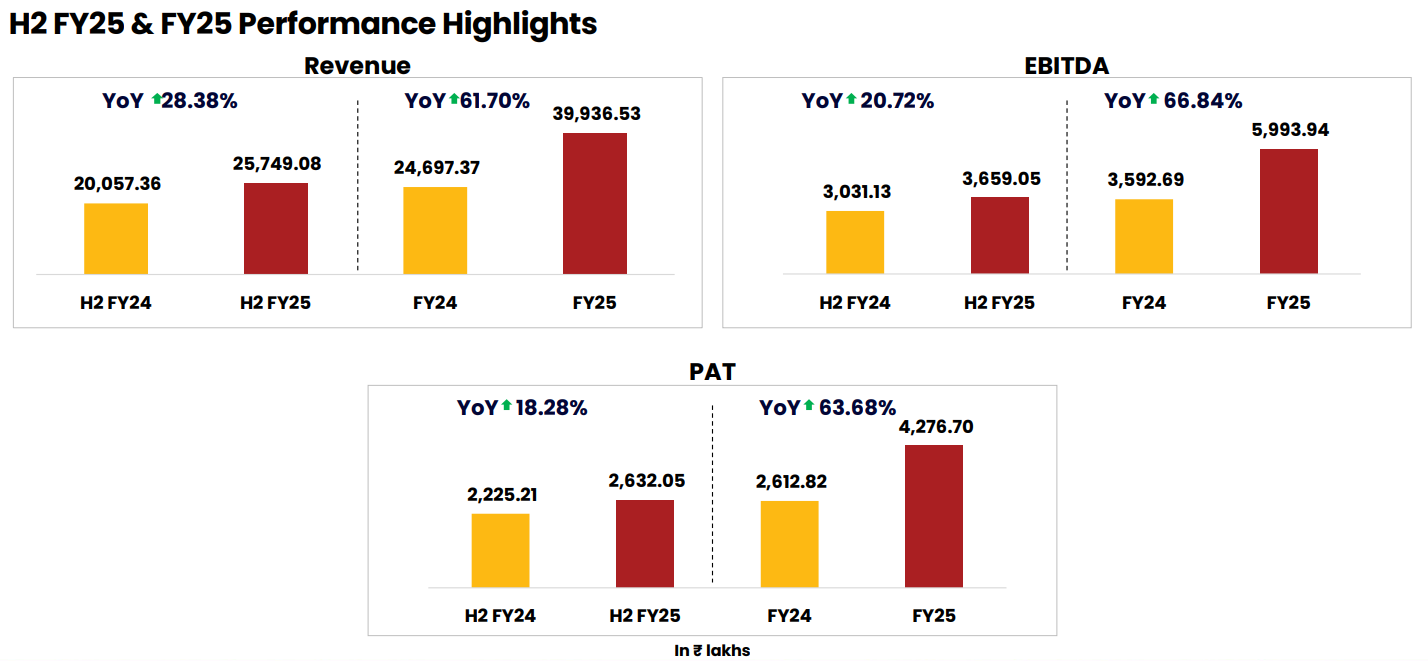

Revenue Growth : FY25 Total Income: ₹399 Cr (FY24: ₹247 Cr )

Growth: 60% YoY

Profit Before Tax (PBT) FY25: ₹57.33 Cr FY24: ₹34.94 Cr

Growth: 64.1% YoY

Net Profit (PAT) FY25: ₹42.77 Cr FY24: ₹26.13 Cr

Growth: 63.7% YoY

ORDER BOOK : ₹870++ crore worth of ongoing projects as their "order in hand".

Why were Trade receivables high at year-end?

Sathlokhar’s business is back-ended, with a large portion of billing happening in Q4. In FY25, ₹230 crore (majority of the bill value came from the Vinfast project) was billed in Q4 alone (Jan–Mar 2025). Q: How much of that ₹230 crore is still outstanding? As of May 2025: ₹60-65 crore is still receivable (excluding retention). Of the total, about ₹70 crore has already been collected in Q1 FY26. - The payment timeline is: 60–70% paid during project execution. -The remaining (minus 10% retention) is received within 90–120 days post-completion. - Retention (around 10%) is held longer, based on contract terms

What’s their view on working capital needs for future growth?

To hit their FY26 revenue target (~₹600 Cr), they estimate needing around ₹150 crore in working capital. - They prefer to work with client advances and are conservative on taking loans – though banks are ready to support them if needed.

Growth Outlook (FY26) Targeting ₹600+ Cr revenue (50% growth YoY) - Conservative Basis , May surpass this if Jammu order finalizes (My Views)

₹7,000+ Cr worth of quotations floated , Expecting a 15% success rate

Understand More about Behavioral Finance & Mental models.

Conclusion

In conclusion, most of the featured companies have delivered exceptional performance, with revenue growth ranging from 24% to as high as 60%, alongside strong bottom-line results. I don’t foresee any significant challenges(Holding all Except Apollo micro systems ) across these companies at the moment.

As we approach Q4FY25, I will continue to monitor their progress and share updates with you. We’ll navigate these market waves together, and I’m excited to keep you informed.

I encourage you to click on the links provided for a deeper dive into the details. If you’re new to my newsletter, I recommend starting with the original post to better connect the dots and fully appreciate the insights shared.

Ultimately, the best investment depends on your risk tolerance, return expectations, and alignment with each company's strategic focus.

Happy investing!❤️

Your Support Means the World!😍

If you have found value in my detailed analysis and insights, and wish to support the effort behind this research, I’d be deeply grateful for any contributions you can make. Your support will help me continue to provide high-quality, in-depth analysis and maintain the quality of work that you’ve come to expect from me.

A contribution of ₹299 or ₹399 would be appreciated to keep the content flowing.

You can Support via PhonePe/ Buymeacoffee using the QR code below(OPTIONAL) :

Don’t forget to click the ❤️ button to help others discover it on Substack ! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

With Love & optimism,

A View-Point from Investor’s Lens 🧐

See you next time, Happy investing!