🏗️From Blueprint to Benchmark—This EPC Company Wants to Be the Mini L&T!

#02 Highlights: With a strong order pipeline and execution efficiency, the company aims to grow at 40–50% sales CAGR over the next few years, scaling rapidly while maintaining profitability.

Sathlokhar Synergys E&C Global Limited —This EPC Player is Expanding Fast!

A rare EPC player that delivers profitability without debt—and does it on time, every time.

✅ Debt-Free Growth

✅ High EBITDA Margins

✅ Efficient Execution

About Sathlokhar Synergys Ltd

Sathlokhar Synergys E&C Global Limited (SSEGL) is an emerging player in the EPC (Engineering, Procurement, and Construction) space, catering to industrial, commercial, and institutional construction projects. Their offerings include turnkey solutions spanning civil engineering, PEB (Pre-Engineered Buildings), MEP (Mechanical, Electrical, Plumbing), IBMS , utilities , office interiors & solar projects.

🧐"But , SSEGL’s Moat ? A one-stop solution for turnkey projects with zero outsourcing—speed, precision, and accountability all under one roof."

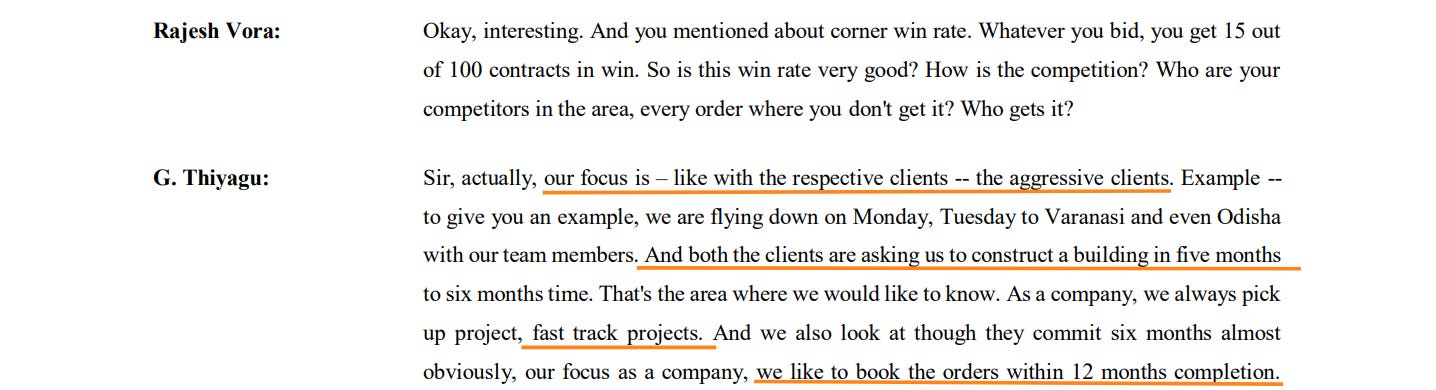

1️⃣SSEGL follows a vertically integrated model, focusing on fast-track project delivery and efficiently handling complex, large-scale projects for seamless execution.

End-to-End Services: From planning & design to execution and commissioning.

In-house Integrated Model: SSEGL does not subcontract project disciplines, which ensures better control over quality and timelines (within 12 months).

One-Stop Solution: Comprehensive packages, including civil works, electrical systems, firefighting solutions etc. , provide convenience & cost efficiency to clients.

2️⃣ Distribution of Solar System: The company also undertakes EPC projects for government agencies through competitive bidding processes. SSEGL is an authorized dealer of TATA Power Solar Systems Ltd., providing installation, sales, commissioning, and maintenance services for its solar power projects under mutually agreed terms and conditions.

Order Book

SSEGL’s order book is ₹1124 crores , with recent orders including ₹61 crore for a warehouse from Reliance Mappedu Multi Modal Logistics Park and ₹48 crore for a Solar Manufacturing plant from Vikram Solar. Recent Announcements,

Geographical Expansion : SSEGL has expanded across Uttar Pradesh, Karnataka, Tamil Nadu, West Bengal and is now entering Odisha, Jammu & Andhra Pradesh.

Completed 68 projects till date, including Reliance’s Campa Cola factories (Varanasi & Mysuru) delivered in record time.

Clientele : The company’s clientele includes household names like Reliance, Godrej, SP Apparel, and VinFast (Vietnam). Over 80% of their clients are international firms(Companies based in USA, Switzerland, Japan, Vietnam ,Spain & Sri Lanka ), drawn by their integrated project capabilities.

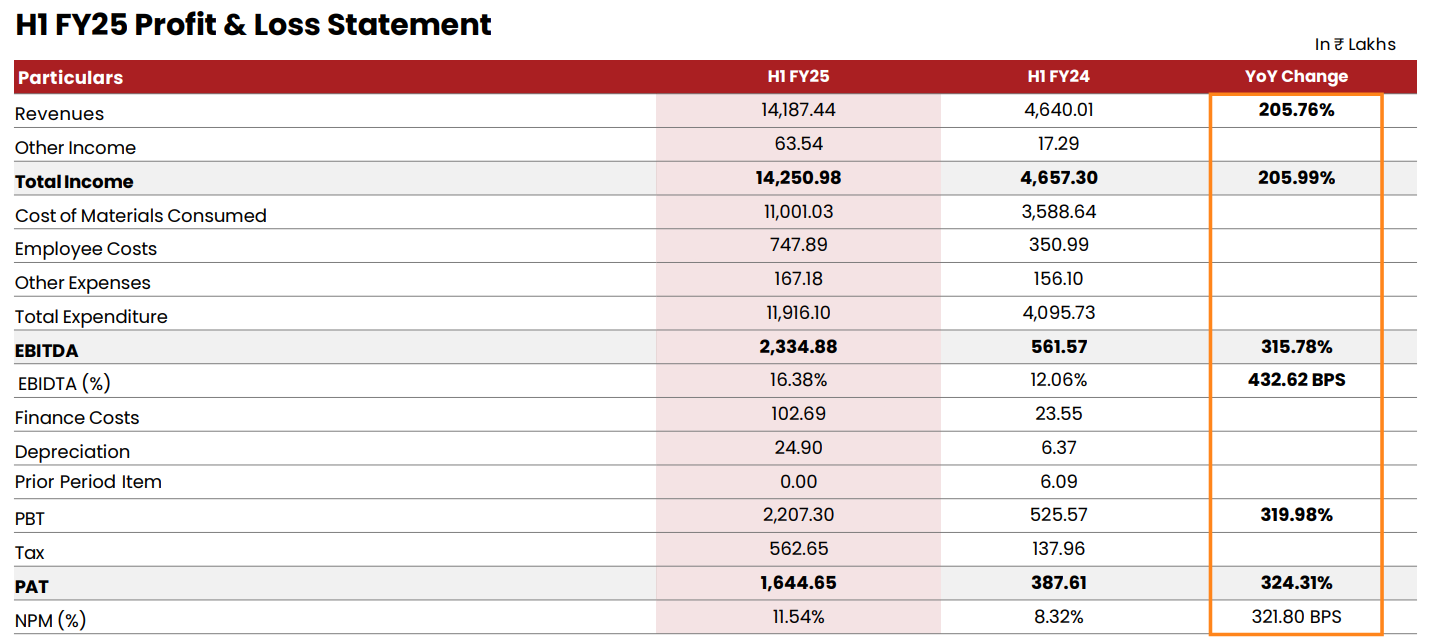

Financial Snapshot (H1 FY25 vs. H1 FY24)

Total Revenue: ₹46.57 crores to ₹142.51 crores (205.99% growth⬆️)

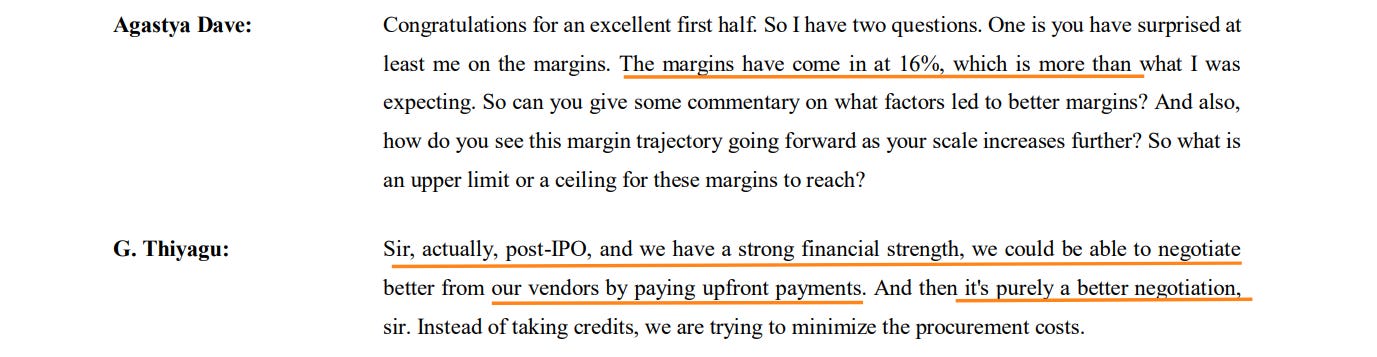

EBITDA: ₹5.62 crores to ₹23.35 crores (315.78% growth),

EBITDA margin up from 12.06% to 16.38%.

PAT: ₹3.88 crores to ₹16.45 crores (324.31% growth), PAT margin up from 8.32% to 11.54%.

Debt and Working Capital : The company has increased the use of bank guarantees, leading to an increase in interest costs. Receivables increased from INR 13 crores to INR 73 crores as the billing cycle is usually around 9 months.

Future Outlook

1️⃣Pipeline Projects (Total Bidded Value): ₹5,795 crores across industrial, solar, and institutional projects. Expected Bid Conversion Rate: 12–15%.

Potential Order Inflow: ₹700–850 crores(tentative) in the near term, supporting future revenue growth, Targeting high-value, high-margin projects to sustain profitability and optimize resource utilization.

Growing client Base : The company is aiming to acquire 300+ clients, which would secure the growth of the company for the next decade, as each client may expand or seek new buildings after 3 to 5 years.

2️⃣Core USP : One-Stop Solution for Industrial Buildings - The company has a unique selling proposition (USP) of ensuring industrial buildings are constructed at a rate of ₹996 per square foot excluding certain items such as compound walls & ceilings and ₹2346 per square foot for commercial & institutional buildings.

3️⃣ Focus on Larger Projects : The company has a dedicated design team of 12-15 people to provide complete design solutions and facilitate approvals. By taking on larger-scale projects, SSEGL aims to leverage fixed costs, improve operating efficiencies, and drive profitability.

4️⃣ Solar Division Expansion : SSEGL is enhancing its solar capabilities with greenfield, rooftop, and residential solar projects, margin for solar projects is around 15% and the business cycle is usually about 4 months.

5️⃣ Client Acquisition by Billboard Advertising in Airports : The company has placed advertisements on approximately 6 screens at Chennai airport. These screens are positioned so that travellers have to pass by them when checking in, ensuring high visibility. Similar advertising has been implemented at Coimbatore, Madurai, and Tuticorin airports.

The targeted audience for these airport advertisements is decision-makers, such as Chairmen, Vice Presidents, CEOs, and General Managers, who frequently travel.

Management Commentary

The management of SSEGL has expressed a highly optimistic outlook for the company's future performance, projecting strong revenue growth(At least 40% to 50% growth in sales) and sustained profitability.

FY25 : The company aims to generate an additional ₹260.63 crores in H2 FY25, targeting a total revenue of ₹402 crores for FY25, reflecting a 60% growth compared to ₹247 crores in FY24.

FY26 : Aiming for a minimum growth of 40% in revenue. SSEGL indicated that for every ₹30 crore of working capital, the company can achieve ₹100 crore turnover.

Long Term Guidance : Expect to reach a revenue of INR 1,000 crores by FY27/FY28 without raising any further external debt.

EBITDA Margins : They expect to improve margins by minimizing the credit system with vendors and reducing procurement costs by paying upfront, aiming for an additional 2% improvement in the bottom line.

Anti thesis pointers

Working Capital & Liquidity Risk : The business is working capital intensive with long implementation periods. A significant portion of the company's working capital is often tied up due to long project cycles.

Concentration of Business in Specific States: The company's business is heavily concentrated in Tamil Nadu & Karnataka. A significant portion of revenue comes from these two states.

Client Concentration: Top 10 customers contribute 89.20%, 80.11% and 77.55% of total sales for Fiscal 2024, 2023 and 2022, respectively.

Supplier Concentration : Top 10 suppliers contribute 45.88%, 40.90% and 53.92% of total purchase for the Fiscal 2024, 2023 and 2022 respectively.

Industry (EPC) Valuation : Trades at a premium valuation due to its core strengths. A P/E de-rating could lead to significant damage, yet amidst this market downfall, still shows a strong Relative Strength.

Conclusion

With zero debt, strong profitability, and operational efficiency, this EPC player stands out in a sector where most competitors struggle with leverage and execution delays. Its ability to secure high-margin projects, negotiate better vendor terms, and rapidly execute contracts—like the recent Varanasi project with a five-month deadline—highlights its competitive edge.

The company is also aggressively expanding into new geographies like Uttar Pradesh, Karnataka, Odisha, and Andhra Pradesh, further diversifying its revenue base. The solar division is another key growth lever, tapping into India’s accelerating clean energy transition. Additionally, with a ₹5,795 crore bidded order book and a 12–15% expected conversion rate, the pipeline remains strong, ensuring future revenue visibility.

However, challenges remain—scalability and sustaining margins in a competitive landscape will be critical. But with an asset-light model, growing client base, and disciplined execution, this company is making all the right moves.

The key question now: Can it continue delivering high-margin, high-growth execution in a capital-intensive industry where most falter?

Being a SME company , Execution will be the key, as only consistent delivery on the stated targets will instill confidence & drive meaningful progress.

Ultimately, the best investment depends on your risk tolerance, return expectations & alignment with each company's strategic focus.

Happy investing!

Your Support Means the World!

If you have found value in my detailed analysis and insights, and wish to support the effort behind this research, I’d be deeply grateful for any contributions you can make. Your support will help me continue to provide high-quality, in-depth analysis and maintain the quality of work that you’ve come to expect from me.

A contribution of ₹299 or ₹399 would be appreciated to keep the content flowing.

You can Support via PhonePe/ Buymeacoffee using the QR code below(OPTIONAL) :

Don’t forget to click the ❤️ button to help others discover it on Substack ! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

With Love & optimism,

A View-Point from Investor’s Lens 🧐

See you next time, Happy investing!

Sources

1. Latest Financial metrics - H1FY25 Investor presentation

2. Management Interviews , Annual Presentations FY24

3. This newsletter is Written based on data as per Feb 2025. Consider crosschecking.

Apologies, I forgot to put Disclosure statement earlier.

Disclaimer: I’m invested in this company, so my views may be Biased