P.N. Gadgil Jewellers - A Glittering Opportunity in the Organized Jewellery Market

#03 Highlights : This heritage jewellry brand aims for ₹9,500 crore in revenue by FY26, targeting market leadership in Maharashtra and projected gross margin of 10-12% within next 3 quarters.

Heritage Meets Modernity: P.N. Gadgil’s Path to Market Leadership in Maharashtra

Disclosure : Invested & Biased

Industry Overview

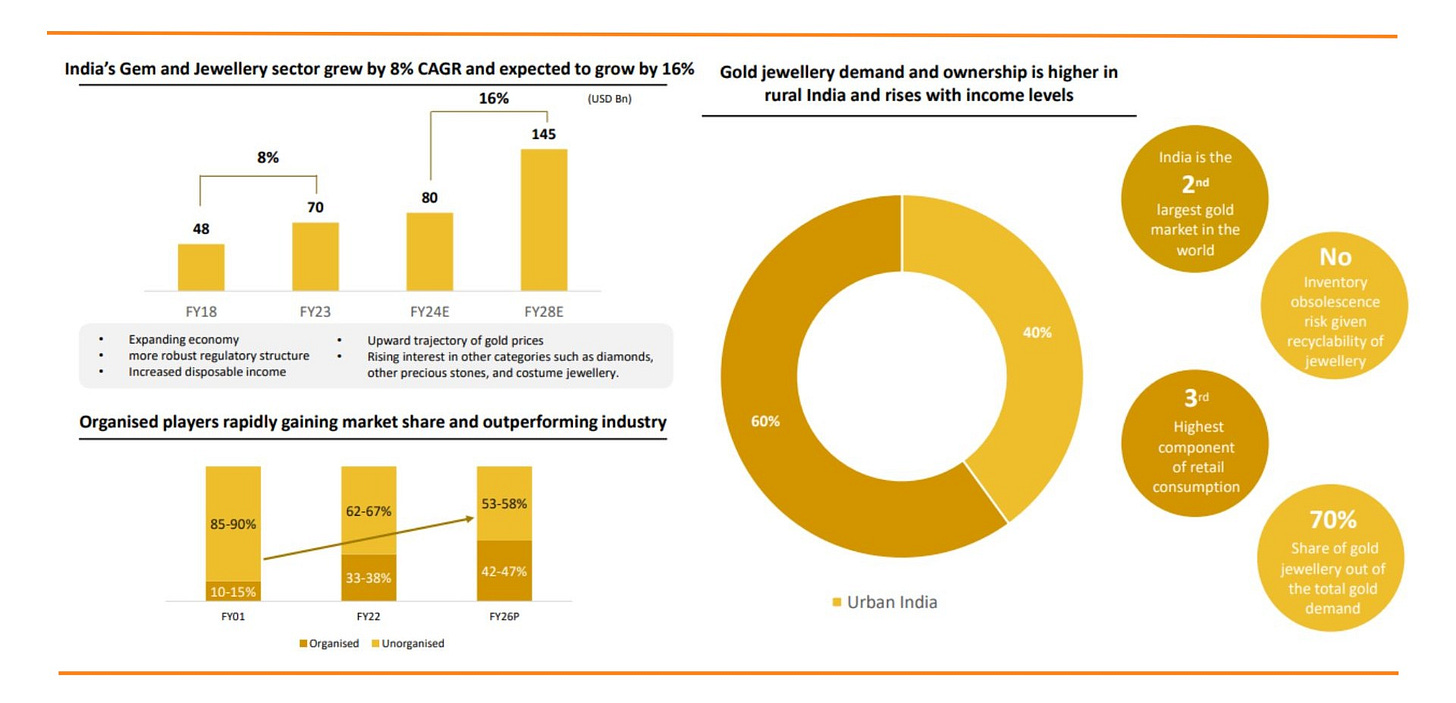

The Indian branded retail Jewelry market is on a robust growth trajectory, with a current market size of approximately USD 80 billion. The sector has been growing at a consistent 8% CAGR and is expected to accelerate to a 16% CAGR in the near future, reaching USD 145 billion, fueled by a growing economy and regulatory reforms. The organized retail sector is poised to capture a larger market share, driven by increased consumer awareness of brands, a growing demand for reliability, and a rising middle class with higher disposable income.

Here are some key trends and statistics --:)

1️⃣ Market Size: India is the second-largest gold consumer globally, with jewelry accounting for 70% of total gold demand. The demand for gold jewelry is further segmented by bridal jewellry (50-55%) and daily wear (35-40%), with a rising trend in lighter, fashion-forward pieces.

2️⃣ Organised vs Unorganised Sector: The share of Organised retail in the jewelry market is expected to reach 40%-50% by 2026, up from just 5%-10% in 2000. This shift is driven by consumer preference for branded, transparent, quality-assured jewellery offerings , bolstered by the rise of digital channels and improved customer service.

3️⃣ Regulatory Support : Government measures like Mandatory BIS hallmarking and stricter anti-money laundering regulations are creating a more transparent and trustworthy market environment, further boosting consumer confidence and benefiting organised player.

South India contributes the largest share (40%) to the Indian Jewellery market, followed by West (25%), North (20%), and East (15%).

About P.N. Gadgil Jewellers

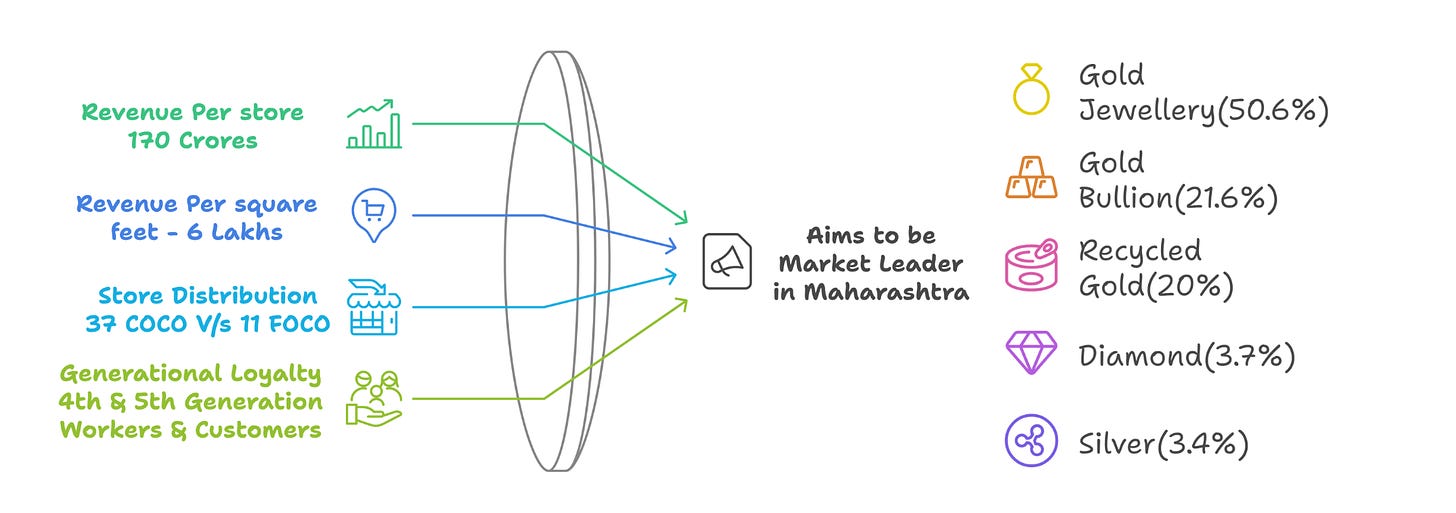

Founded in 1832, P.N. Gadgil Jewellers has built a legacy of trust and craftsmanship, specializing in gold, silver, and diamond jewellery. With a rich history spanning nearly two centuries, the company today operates with a dynamic dual business model, with 48 stores as of November 2024—37 under the Company-Owned and Company-Managed (COCO) model and 11 under the Franchise-Owned and Company-Operated (FOCO) model.

1️⃣ The 37 COCO stores, primarily located in Tier 1 cities such as Mumbai, Pune, and Nagpur, form the backbone of the company’s operations, contributing the majority of revenue. This model allows for complete control over brand quality, customer experience, and product consistency.

2️⃣ The 11 strategically located FOCO stores in Tier 2 and Tier 3 cities play a crucial role in expanding the company’s reach, tapping into new customer bases while minimizing the financial risks typically associated with rapid expansion.

The company aims to become the leading Jewelry retailer in the Maharashtra region, by leveraging the strength of COCO stores in major metropolitan hubs and strategically expanding with FOCO stores in emerging markets. This approach ensures a broad market reach, allowing the company to cater to diverse customer segments while capitalizing on opportunities across Maharashtra.

KPIs [Key performance Indicators]

1️⃣ Inventory Days : The company boasts an impressive inventory turnover, with just 63 days—significantly faster than competitors like Kalyan Jewellers (191 days) and Senco Gold (202 days). This efficiency minimizes holding costs, enables quick market response, and achieves a high inventory turnover ratio of 5 times per year.

2️⃣ Stud Ratio: The stud ratio means, the percentage of diamonds used in gold jewellery, directly impacts profitability. P.N. Gadgil Jewellers currently has a stud ratio of around 11% and aims to increase it to 15%.This strategic move will boost profitability due to the higher margins associated with diamond-studded jewellery.

3️⃣ New Store breakeven period: Company anticipates new stores will reach breakeven within 15-18 months. Stores opened before major festivals like Diwali or Navratri may break even sooner (12-15 months) due to higher consumer spending. The company targets a 1.5 stock turn in the second year (FY26), generating INR 60-65 crores in revenue. With a significant portion of sales from made-to-order items, P.N. Gadgil keeps inventory levels lower than competitors, improving cash flow efficiency.

4️⃣ Increasing FootFall : Store footfall rose by 27.7% from Fiscal 2022 to 2024, with average transaction values growing at a CAGR of 16.46% for gold, 22.69% for diamonds. The focus is on driving profits through footfall to Conversion Ratio (currently 93%) , Digital initatives & Brand Ambassadors (Madhuri Dixit) and transaction value via targeted marketing, outreach, and loyalty programs.

Future Outlook

1️⃣ New Store Expansion: Recently they opened 9 new stores in 9 days during Navratri . The company has a robust expansion plan, aiming to open 5-6 new stores in Q3 and Q4 of FY25, followed by 10-15 stores in FY26. This will increase their store count to over 60-65, surpassing Titan's presence in Maharashtra and making them the market leader.

2️⃣ Geographical Expansion: Once the company achieves market leadership in Maharashtra, it plans to expand to other states by following Peshwa route, targeting regions like Madhya Pradesh, Chhattisgarh, Bihar, and Delhi. The company intends to leverage its strong brand reputation built in Maharashtra to attract customers in new markets.

3️⃣ Reducing Finance Costs by Increasing GML share : Company is working to reduce its finance costs by shifting from high-interest bank loans (9% pre-IPO) to Gold Metal Loans (GMLs) with lower rates. The company aims to increase its GML share to 70% by March 2025. This strategy, along with restructuring bank borrowings and breaking the consortium of lenders, will lower its debt cost to 5-5.5%. These efforts, alongside reduced procurement costs through the India International Bullion Exchange (IIBX), Operating Leverage and renegotiations with artisans, are expected to improve gross margins by 1-2%.

4️⃣ Management Guidance for Revenue and EBITDA Margins: The management has set an ambitious revenue target of INR 8,000 crores for FY25 and INR 9,500- 10,000 crores for FY26. They also aim to achieve a gross margin of 10-12% in the next 2-3 quarters, primarily driven by increasing their studded jewellery sales and optimising their sourcing and production costs.

5️⃣Custom Duty Impact: The recent reduction in custom duty on gold imports had a mixed impact on the company's performance in Q2 FY25. While it resulted in an inventory loss of INR 18.5 crores, the company was able to offset this by increasing sales volume. The company expects the net impact of the duty reduction to be around INR 3.31 crores.

Peers Comparison

Let’s Compare P.N. Gadgil Jewellers (PNG) against listed peer Senco Gold, here are the key financial metrics and qualitative factors to focus on for a comprehensive Peer comparison :-

P.N. Gadgil commands a premium valuation with a 46% revenue growth, superior ROCE, operational Excellence, faster inventory turnover (63 days), Dominance in Maharashtra, Generational Loyalty with 4th & 5th Generation Workers and Customers & strategic focus on cost-efficient Gold Metal Loans. (Reasonable Valuations : Around 40X on FY25 Basis)

Risks/Challenges

1️⃣ Geographical Concentration: Company currently derives most of its revenue from Maharashtra. This geographical concentration exposes the company to risks specific to the region, such as economic downturns, changes in local regulations.

2️⃣ Brand Misconceptions: The management addressed potential customer confusion regarding the brand name, specifically the differentiation between P.N. Gadgil Jewellers and P. N. Gadgil & Sons. They emphasised that P.N. Gadgil Jewellers is a distinct entity with its own brand identity, logo, and customer experience. They have implemented awareness campaigns to clarify any misconceptions and ensure customer understanding.

Anti-Thesis For sector

Several challenges and risks faced by all Indian retail Jewellery companies:

Gold Price Volatility & Competition: Gold prices fluctuate due to global economic conditions, geopolitical events, and investor sentiment, impacting profitability. In addition, the highly competitive Indian jewelry market, with both organised and Unorganised players, intensifies price wars and margin pressures, requiring businesses to employ robust hedging strategies and continuous innovation to stay competitive.

Changing Consumer Preferences: Evolving consumer preferences for jewelry styles require constant adaptation. Failing to stay ahead of trends can lead to inventory obsolescence and declining sales.

Regulatory Changes: Jewelry businesses face regulatory risks from changes in taxation, hallmarking, and import duties. These shifts can impact costs and create compliance challenges, as seen with the recent duty cut on gold imports.

Conclusion: Let the Numbers Guide You

From operational excellence to regional dominance, P.N. Gadgil Jewellers and Senco Gold bring distinct strengths to the table.

P.N. Gadgil Jewellers, while regionally focused in Maharashtra, stands out with its operational excellence, particularly its exceptionally high footfall-to-conversion rate(93%), indicating strong brand loyalty and effective customer engagement strategies. The company's rapid revenue growth and industry-leading revenue per store suggest significant potential as it expands its footprint.

Senco Gold, with its expansive store network and strong presence in Eastern India, strategic utilisation of Gold Metal Loans (GML) for both sourcing and hedging highlights its focus on efficient working capital management and mitigating gold price volatility.

Ultimately, the best investment depends on your risk tolerance, return expectations, and alignment with each company's strategic focus. Happy investing!

With Love & optimism,

A View-Point from Investor’s Lens

If you found this article helpful, don’t forget to click the ❤️ button to help others discover it on Substack! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

See you next time, Happy investing!

Sources

1. Latest Financial metrics - Q2FY25 Investor presentation & Earnings Call

2. IPO Note on PN Gadgil Jewelers : Research Report by Dolat Capital

3. Source: Technopak Analysis, MOFSL, Secondary Research

THE STUD RATIO IS 7.5% FOR PNG NOT 11%