Newsletter Performance Review : The Q3FY25 Reflection

Q3 Highlights : Exploring key business updates, Quarterly results & Growth Trajectories of featured companies - SGMart, India Shelter Housing Finance, P.N Gadgil, RBZ Jewellers & Apollo Micro Systems

The Q3FY25 Results Season is Behind Us: Time to Reflect & Review

As Q3FY25 results settle in, it’s a good time to pause and reflect. Since mid-November 2024, I’ve highlighted five companies, but with only 3-4 months passing, it’s tough to gauge the price performance accurately in such a short span.

The past few weeks have been particularly challenging for stock market investors. Since the first week of October, the market has faced significant turbulence:

The Nifty 50 has dropped by 15% 🔻

The Nifty 500 Index has fallen by 20% 🔻

The Nifty Smallcap 250 has plunged by 26% 🔻

As we navigate these turbulent times, it’s essential to revisit the companies covered in my previous newsletters and assess how they are weathering the storm. Let’s dive into the latest insights from these five companies in light of the broader market shifts.

1️⃣SGMART

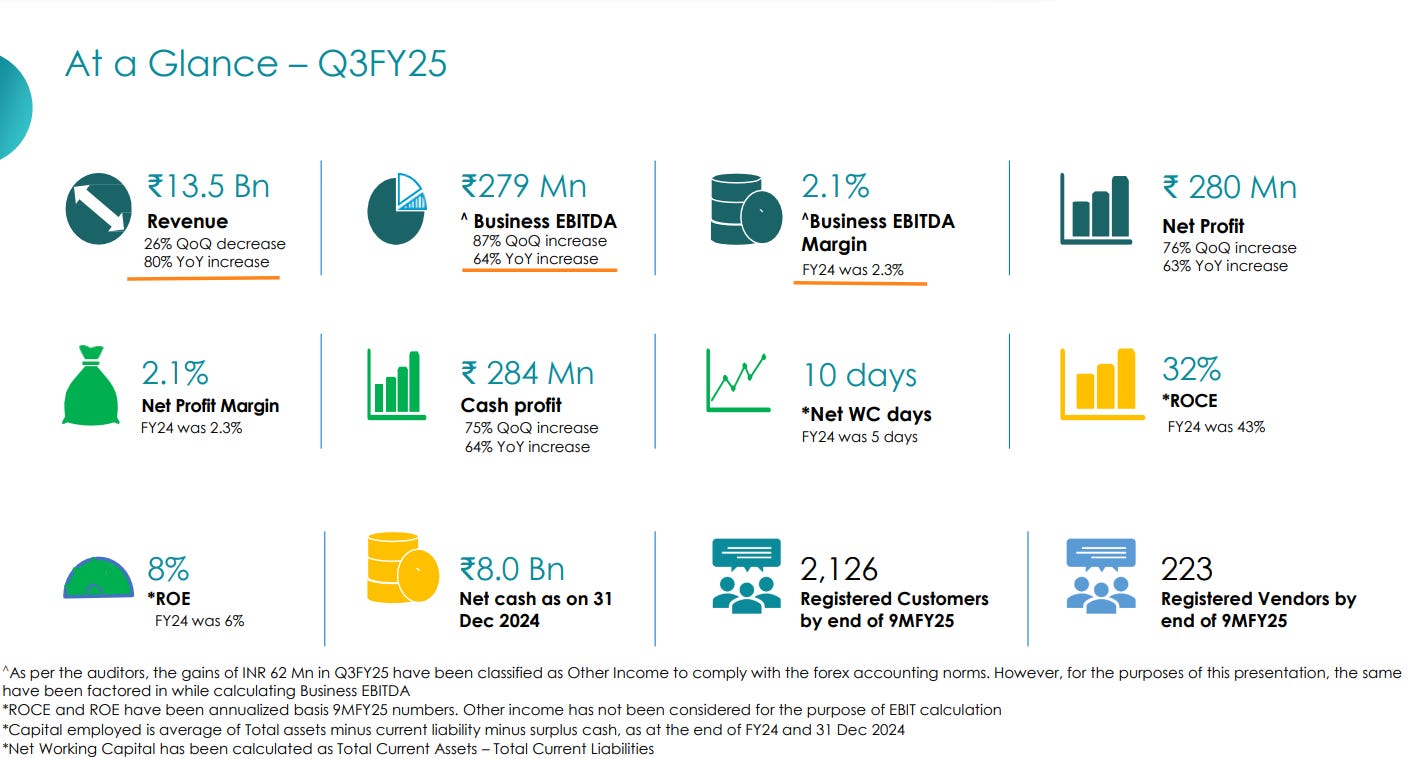

Good Results | SGMART Original Newsletter | Investor PPT | One pager Summary

Revenue - ₹1350 Cr (80% YOY) ⏫

Business EBITDA Margin- ₹279 Mn (64% YOY) ⏫

Net Profit Margin - 2.1% (No inventory losses this quarter)

Q4 Revenue Guidance: Expected between ₹1,500-1,700 Cr, potential ₹1,800 Cr if construction activity picks up.

FY25 guidance: ₹6,000 Cr (Previous Guidance :7000 Cr, Reduced due to a 15% crash in steel prices).

FY26 revenue expected to grow by 40% to reach 9500-10,000 Cr.[Concall Notes]

Margins expected: 2.1% to 2.25%, targeting 2.5% with more service centres and solar sales.

FY27 Guidance : The management clarified that the 18,000 Cr revenue number for FY27 will vary depending on the steel prices, and that the target is 3 million tons of volume. Focus on increasing per ton earnings (currently ₹1000/ton, aiming for ₹1300/ton).

The company is in talks with all top five steel manufacturers and is sourcing from four of them. Aims to have 15 service centers operational and 10 under construction in the next 15-20 months.

2️⃣India Shelter Finance Corporation

Good Results | Original Newsletter | Investor PPT Summary

AUM growth 36% YoY ⏫to Rs. 7,619 Cr

Disbursements grew by 29% YoY ⏫

Average Ticket Size (ATS): ~₹10 Lacs

Branch Network: ISFC continues to expand its presence with a total of 265 branches across 15 states , Added 5 new branches in Q3FY25 , will continue adding 40-45 branches for the year as guided in FY25.

Operating Leverage : The company is improving efficiency with Opex to AUM ratio improving to 4.3% and the Cost to Income ratio improving to 37.4%.

Focus on Underserved Segments: ISFC primarily serves first-time mortgage borrowers in Tier II and Tier III cities, catering to the low- and middle-income segments, including Economically Weaker Section (EWS) and Low Income Group (LIG) customers.

Reducing Attrition : Management noted that a new team was hired in Madhya Pradesh, easing regional stress. To further reduce attrition, the company increased the ESOP allocation from 15% to 25% for branch managers and above, with attrition under 10% in specific categories.

3️⃣ P.N Gadgil Jewellers

Good Results | Original Newsletter | Investor PPT | Q3 Transcript

Q3FY25 Revenue: INR 2,435 crores, up 23.5% YoY ⏫

EBITDA: INR 129 crores, Up 37.2% YoY⏫ , with a margin of 5.3%

Consolidated PAT: INR 86 crores, Up 50% YoY ⏫ , with a PAT margin of 3.5%

Retail Segment: 42% growth, contributing INR 1,878 crores , E-commerce Segment: Nearly 100% growth, reaching INR 70 crores , Franchisee Segment: 87% growth, contributing INR 227 crores , Same Store Sales Growth (SSG) remains strong at 26%.

Customer Engagement : Transaction volume increased by 21%, & the average transaction value increased by 22% to 86,000 per transaction. A 36% increase in footfalls was recorded, supported by a strong conversion ratio of 93%.

Store Expansion : On track to reach 53 stores by Q4 FY25. Plans to add 25 stores in the next financial year, a mix of franchisee and company-owned stores.

Hedging Strategy: The percentage of gold hedged through GML rose from 12% in the previous quarter to over 45%. As of December, the hedging stood at 83.6%, with the position fully hedged by January.

4️⃣ RBZ Jewellers

BlockBuster Results | Q3 Transcript | One Page Summary

RBZ Jewellers has posted robust revenue growth of 67% on YOY⏫ to Rs. 194 Cr from Rs. 116 CR in Q3FY24.

Company has got an operating leverage as PAT grew by 86% on YOY ⏫ to Rs. 13 Cr in Q3 from Rs. 7 Cr in Q3FY24. EPS also grew by 92% on YOY to Rs. 3.27

Projected FY25 Revenue: 520-535 Cr , Projected PAT : Rs. 35 Cr (9M PAT – Rs. 30.08 Cr); Company can easily surpass the PAT guidance.

FY26 Revenue Guidance : Rs. 700-750 Cr , PAT : Rs. 44-45 Cr

Long Term FY27 Revenue Guidance : Rs 1000 Cr

Management is confident to achieve consistent growth of 35% CAGR on YOY basis in the topline.

RBZ jewellers has already done around 1005 Kgs of Gold in 9MFY25, and company expects to reach around 1250-1300 Kgs of gold in FY25.

ROE target: 20-25% , Joint MD Harit Rajendra Kumar Zaveri temporarily handling CFO role. New financial controller role to be filled in 2-3 months, promoting to CFO in 12-18 months.

5️⃣Apollo Micro Systems

Original Newsletter | Investor PPT| Earnings Transcript | One Pager Summary

Revenue Growth: 9M FY25 : ₹236.2 Cr → ₹400.3 Cr (69.5%) YOY 🔼

Q3 FY25 : ₹91.3 Cr → ₹148.4 Cr (62.5%) YOY 🔼

Expansion & Strategic Moves - Unit 2 facility ready, operations starting from Q1 FY26 , Unit 3 (350,000 sq. ft.) for weapon integration to be completed by Q2 FY26

Current Order Book: ₹500-550 Cr (Targeting ₹2,500 Cr by Dec 2025)

Revenue Growth Guidance - FY26 Target: ₹800-850 Cr (2X from FY25 ).

Fund Utilization

- ₹550 Cr raised for working capital ; ₹66 Cr for subsidiary acquisitions

- ₹130-140 Cr for corporate expenses ; ₹100 Cr planned for R&D next year

Promoter pledge(currently 33%) to be reduced to 0% in the next year.

key Insights from Investor Q&A

- Not a single-source supplier (participates in tenders)

- Large-scale growth expected in artillery & bomb programs

- Repeat orders for torpedoes & ALWT (Advanced Lightweight Torpedo) expected in Q3/Q4 FY26 .

- No payment delays from Govt. ; Order execution timeline: 6-14 months

-Targeting a 60:40 production-to-development mix by FY26 [Currently at 75: 25]

Conclusion

In conclusion, most of the featured companies have delivered exceptional performance, with revenue growth ranging from 24% to as high as 80%, alongside strong bottom-line results. I don’t foresee any significant challenges across these companies at the moment.

As we approach Q4FY25, I will continue to monitor their progress and share updates with you. We’ll navigate these market waves together, and I’m excited to keep you informed.

I encourage you to click on the links provided for a deeper dive into the details. If you’re new to my newsletter, I recommend starting with the original post to better connect the dots and fully appreciate the insights shared.

Ultimately, the best investment depends on your risk tolerance, return expectations, and alignment with each company's strategic focus.

Happy investing!❤️

Your Support Means the World!😍

If you have found value in my detailed analysis and insights, and wish to support the effort behind this research, I’d be deeply grateful for any contributions you can make. Your support will help me continue to provide high-quality, in-depth analysis and maintain the quality of work that you’ve come to expect from me.

A contribution of ₹249 or ₹299 would be appreciated to keep the content flowing.

You can Support via PhonePe/ Buymeacoffee using the QR code below(OPTIONAL) :

Don’t forget to click the ❤️ button to help others discover it on Substack ! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

With Love & optimism,

A View-Point from Investor’s Lens 🧐

See you next time, Happy investing!

Wonderful read 👍🏻

Nicely summed up

Excellent round up

It's a good time to add at lower levels after the confidence you expressed again Sir