High-Margin Logistics & Global Expansion: The PRL Growth Blueprint 🚛

#03 Highlights: With a 30-35% CAGR Revenue growth target, the company is scaling operations through PRL Supply Chain Solutions, enhancing global logistics, warehousing, and freight services.

Indian Logistics Industry: A High-Growth Sector on the Move

About Premier Roadlines Ltd

Premier Roadlines Limited (PRL) was established in 2008 and has grown into a key player in the logistics industry, specializing in dry cargo transportation. The company operates across four key service verticals:

1️⃣ Project Logistics : Handling end-to-end project logistics, including planning, vehicle selection & meeting customer targets (Capable of moving cargo upto 250 tons).

2️⃣ Over-Dimensional Cargo (ODC) :Transporting cargo that exceeds standard vehicle dimensions( including transformers, turbines, and industrial machinery) often for power, infrastructure, and energy projects.

3️⃣Contracted Integrated Logistics : Long-term logistics contracts (typically 1-2years) for continuous transportation needs (Ranging upto 40 MT).

4️⃣General Logistics : Spot-bidding or ad-hoc transportation services for clients requiring flexible solutions.

PRL serves industries such as energy, renewables, infrastructure, heavy engineering, oil & gas, and defense.

Moat, Clientele & OrderBooks

1. Asset-Right Model : Balancing Flexibility & Control - PRL follows an Asset-Right Model, strategically blending an asset-light approach with selective ownership of specialized assets.

Core Fleet Outsourcing – PRL primarily leases or contracts third-party vehicles, ensuring scalability without high capital expenditure.

Selective Asset Ownership – Recently acquired 2 Volvo pullers & 18 axles to strengthen heavy cargo & ODC capabilities.

Optimized Cost Structure – Maintains low fixed costs while expanding service offerings in high-margin segments like Project Logistics.

2. Long-Standing Client Relationships – 40+ years in logistics, trusted by Tata, L&T, KEC, and Thyssenkrupp, ensuring repeat business and contract renewals.

3. Fleet Management: They use an ERP system to manage a large network of third-party fleet operators (over 1000 associated vehicles), allowing efficient vehicle placement and tracking.

4. Order Book: PRL does not typically work with a traditional order book, but has contracts of approx. Rs 100-120 crores per year for contracted integrated logistics.

5. Q3 Order Updates : PRL secured multiple high-value contracts worth approximately ₹30 crore Read Announcements , covering specialized transportation for Over-Dimensional Cargo (ODC), solar panels, escalators, and general cargo.

6. Latest New order(12/03/2025) : PRL Secures Multiple High-Value Contracts for transporting Renewable Solar Panels from Premier Energies, ReNew Photovoltaics, SAEL, RenewSys India and other leading Renewable Energy companies. of Approx. Rs. 63 Crores. Read Announcements here

In FY24, Project Logistics & ODC(High Margin business) contributed about 60%of the revenue, while General and Contracted Logistics contributed 40%.

Future Outlook

1️⃣ PRL Supply Chain Solutions: Expanding into End-to-End Logistics -Acquired PRL Supply Chain Solutions as a wholly-owned subsidiary to expand services into Ocean Freight, Air Freight, Project Logistics, and Warehousing & Distribution.

This expansion enhances PRL’s service portfolio beyond domestic transportation, entering high-margin segments like global supply chain management. The company is leveraging its existing vendor codes & client base to cross-sell these services, unlocking additional revenue streams.

2️⃣ Geographical Expansion : Strengthening Domestic Reach - PRL is expanding its transport network, opening new branch offices across key industrial hubs.

The goal is to increase visibility and penetration into high-growth markets, improving fleet availability and reducing transit times.

3️⃣ Fleet Expansion (Asset Procurement): Added 4 new pullers and 46 axles in Q3 FY25, costing ₹12.37 crore, funded via internal accruals and bank financing. Fleet size now stands at 6 pullers and 64 axles. These assets, essential for handling heavy transportation tasks such as moving a 260-Ton transformer, will help the company cater to previously unmet demands and boost sales.

4️⃣ Strategic Focus on Project logistics : PRL strategically focuses on high-value, high-margin logistics like Project Logistics and Over-Dimensional Cargo (ODC), ensuring better pricing power, stable cash flows, and stronger profitability by prioritizing long-term contracts with marquee clients over low-margin general logistics work.

5️⃣ODC Consignment Success : Timely Deliveries Exceed Expectations

Pune-Gadchiroli consignment delivered in 26 days (vs. estimated 45 days). Greater Noida-Panipat consignment completed in 18 days (vs. estimated 30 days).

Management Commentary

FY25 Revenue Guidance: PRL has provided a conservative revenue estimate of ₹300 crores for FY25, with 35% expected in H1 and 65% in H2, driven by project logistics. By Q3 of FY25, the company has already achieved ₹193 crores and may surpass the guidance, with an optimistic target of ₹305-320 crores.

Long Term Guidance : The company aims to achieve a CAGR of 30-35% over the next four years.

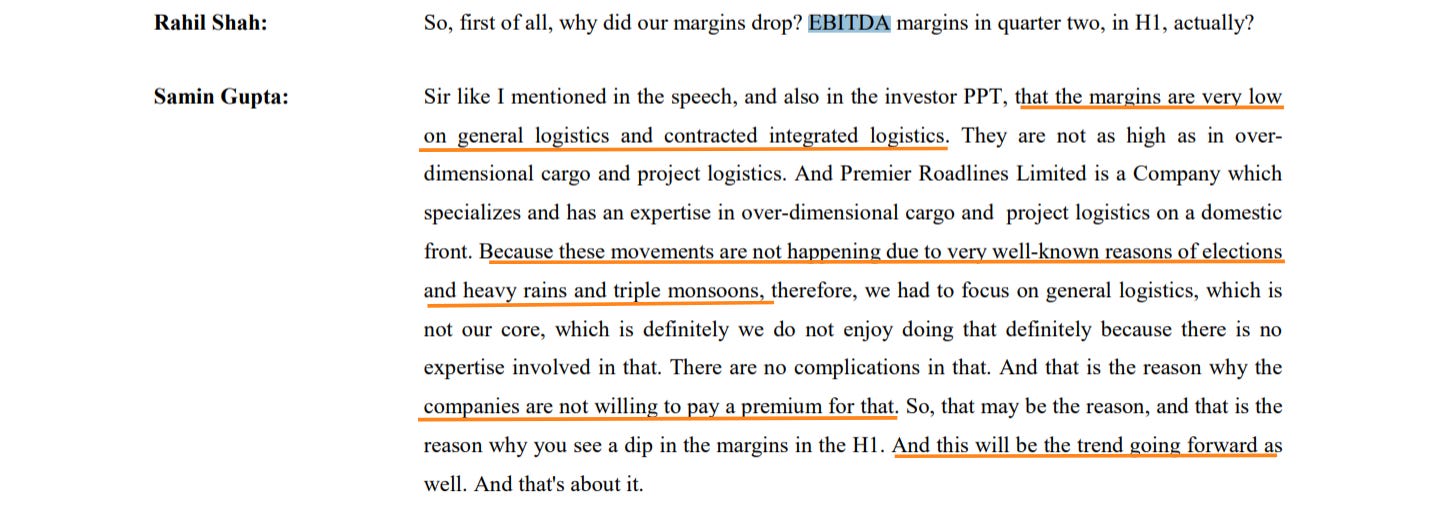

EBITDA Margins : The company expects improved EBITDA margins due to a focus on higher margin services. H1 typically sees lower margins due to seasonality and external factors like monsoons and elections. Margins are expected to improve in H2 with increased demand for project logistics and ODC.

Challenges

Debtor Days: The high number of debtor days remains a concern, though the company is actively addressing it through new systems.

High Trade Receivables: PRL has trade receivables of ₹75 crores as of March 2024, with over 25% owed by two large companies facing payment delays due to internal processes. Despite this, PRL values these clients, who continue to place regular orders, and is patient with the delays.

Management Response to High Trade Receivables: The elevated trade receivables of ₹75 crore as of March 2024 are structural in nature and primarily due to the company’s client profile, which includes large corporates such as Tata ,Adani, and other blue-chip firms. These clients typically operate on extended credit cycles of 90–120 days. While this results in higher receivables on the balance sheet, management emphasized that these are low-risk accounts with consistent payment track records.

Understand More about Trade Receivables in Logistics industry

Competition: While they emphasize their strengths, there is a degree of competition within the logistics sector, particularly from smaller players.

Revenue Mix& Low Liquidity Risks : Changes in Revenue mix can impact Average revenue per order.

Low P/E Valuation: Earnings quality is seen as less predictable (Depends on Revenue Mix) , so market may assigns lower valuation multiples.

Why It find a place in my Newsletter ?

In conclusion, company’s expertise in Over-Dimensional Cargo (ODC), Project Logistics, and General Cargo, combined with its asset-light model, allows it to scale efficiently while maintaining capital discipline(Mainboard Level Quality Management).

The logistics industry is undergoing structural shifts, with organized players gaining market share. PRL’s focus on high-margin, complex transportation solutions positions it well to capitalize on this transition. However, execution risks, cyclicality in infrastructure spending, and competitive pressures remain factors to monitor.

As PRL scales operations and strengthens its capabilities, the key question is: Can the company sustain its growth momentum while maintaining profitability in an evolving logistics landscape?

Being a Micro cap(SME) company with market cap < 300 Cr, Execution will be the key, as only consistent delivery on the stated targets will instill confidence & drive meaningful progress. Ultimately, the best investment depends on your risk tolerance, return expectations, and alignment with each company's strategic focus. Happy investing!

With Love & optimism,

A View-Point from Investor’s Lens

If you found this article helpful, don’t forget to click the ❤️ button to help others discover it on Substack! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

Disclaimer: SME investing involves higher risks due to lower liquidity, limited disclosures, and higher volatility. Do your own research before investing.

“If you’re starting your investing journey, Never cross more than 10-20% of your portfolio in SMEs.”

Disclosure: I currently hold no positions in the stock. This blog was originally written around March, and I had already informed the X community about it at the time. I was initially hesitant to publish it due to the risks associated with SME investing. However, a few of you encouraged me to share it—so here it is.

Please read with discretion and make independent, well-informed decisions.

See you next time, Happy investing!

Sources

1. Latest Financial metrics - Investor presentation & Earnings Call

2. The Logistics industry - BackBone of India

3. Motilal Oswal - Logistics Sector Report: October 2024, Secondary Research

4. Management Interview with Green Portfolio Youtube

5. Premier RoadLines Ltd & Arihant Capital | Bharat connect conference - Rising Star September 2024 Youtube

6. Watch Corporate Video - Youtube Video Link