Decoding the Aerospace Value Chain : How India Fits Into the Global Flight Plan ✈️

Highlights : From OEMs designing aircraft to Tier-3 suppliers machining precision parts here’s the full supply chain explained, and how India is quietly climbing up each tier.

The Real Engine of Aerospace : Value Chain, Margins & India’s Sweet Spot 🔩

Hey folks, If you’ve been scrolling through market chatter lately, I bet you’ve seen the same headline everywhere : “Aerospace sector flying high!”

Nice HEADLINE . But what’s the story?

What’s this “tailwind” everyone’s obsessed with?

And more importantly is it real, or just another short-term buzzword?

See, the aerospace story isn’t about one company or one order. It’s about how global manufacturing itself is shifting, and how India quietly and strategically is sneaking into the cockpit.

Most folks just drop big words : resilience, diversification, value chain shift & move on. But no one tells you what’s actually happening under the hood.

But don’t worry; your friendly neighbourhood analyst is here. 😎

(Think of me as that one person who reads the 50-page aerospace deep dives so you don’t have to.)

So here’s the deal:

Grab your coffee or chai.(you’ll need it)

Give me twenty focused minutes.

I’ll walk you through the entire value chain from Boeing’s boardroom to a Tier-3 supplier in Hosur and show you how this industry actually works.

By the time we land, you’ll know whether the “Aerospace boom” is hype… or history in the making.

Ready? Seatbelt on, caffeine in hand & welcome to today’s masterclass on the Aerospace Sector. Let’s take off.

I. The Global Turbulence That Rewired Aerospace

Alright, so let’s rewind a bit. This entire “Aerospace boom” didn’t just fall from the sky — it was born out of pure chaos.

I’ve broken it down into three simple phases so you can see exactly how one global crisis forced the industry to rewire itself and how that created the perfect opening for Indian players .

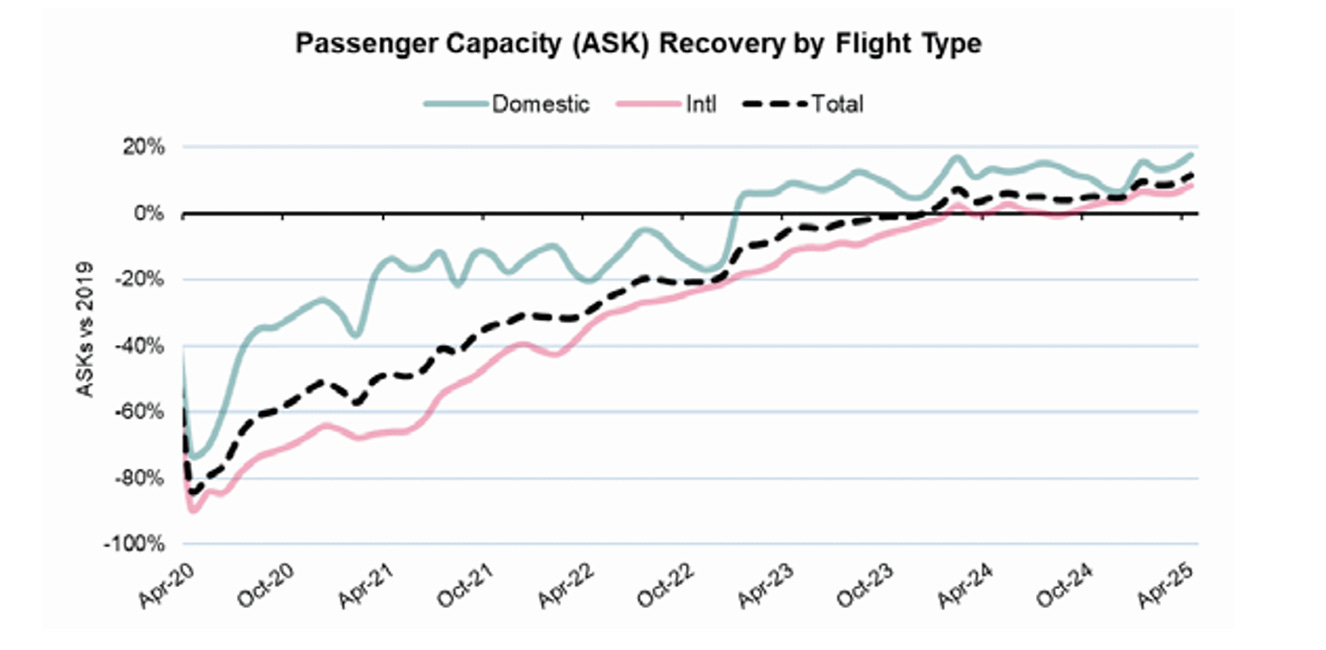

1️⃣The COVID Shock (2020–21): When the Engines Stalled

Imagine the global aerospace supply chain as a tall stack of gears.

When the top gear — airlines — stopped spinning, everything below jammed.

Flights dropped ~65% in 2020. OEMs like Airbus and Boeing slashed production by up to 40%-50%. And just like that, thousands of Tier-2 and Tier-3 suppliers went from “steady order books” to “Radio silence.”

Factories shut. Machinists left. Certifications (e.g., AS9100, NADCAP) expired.

Restarting later wasn’t as easy as “flip the switch.”

Worse, Aerospace isn’t like making bolts for autos. You can’t hire random folks and hope it flies (literally). Each operator, each weld, each alloy is certified. When those people left, they took their skill and their certification with them.

By 2021, supply chains were broken, liquidity dried up, and lead times exploded — from 8–10 weeks to 40+. Many small European suppliers the ones making precision parts for decades simply didn’t come back.

2️⃣ The Recovery Rush (2022–2023): Demand Rebounds, Supply Doesn’t

Then came revenge travel. Demand roared back faster than anyone expected. But there was one small issue “nobody was ready”.

Labour? Gone .

Freight? 3X more expensive.

Cash? Still tight. Geopolitical-risk (Russia/Ukraine, US-China tensions)

Even Tier-1 giants like Spirit AeroSystems and Safran openly said “We just don’t have enough people or parts.”

So OEMs started throwing money around supplier recovery programs, prepayments, co-investments anything to keep the assembly lines running.

But even with all that, production stayed out of sync. Engines delayed planes, planes delayed deliveries, deliveries delayed cash a perfect loop of frustration.

3️⃣ The Structural Shift (2024-25 onwards): The Real Tailwind

Now, this is where things get interesting. Out of that chaos came clarity - the industry can’t depend on one geography anymore.

OEMs and Tier-1s started moving from just-in-time to just-in-case.

They began dual-sourcing, holding buffers, and qualifying new vendors in new countries.

Enter India, Southeast Asia, and Eastern Europe the “friend-shoring” club.

India, in particular, stood out. Why ? Because we had:

✅ A skilled engineering workforce.

✅ Proven ability to manufacture at scale.

✅ Strong IP protection (OEMs love that).

✅ And geopolitically ; we’re the “safe” bet in an uncertain world.

This isn’t cost arbitrage anymore it’s trust arbitrage.

Western OEMs realized they need partners who won’t vanish mid-cycle, and India’s ticking every box.

Add in digitization, ESG pressure, and governments calling aerospace a “strategic sector,” and you’ve got a full-blown structural shift not a short-term rebound.

In short ; COVID grounded planes and half the supply chain with it.

The rebound exposed how fragile the system really was.

Now the entire industry’s rebuilding itself diversified, localised, digital, and more resilient. And guess who’s right at the heart of that rebuild?

Yep — Indian companies .Not only because we’re cheaper.

But because we’ve finally proved we can be reliable, certified, and consistent — the three holy words in aerospace manufacturing. This, my friend, is the real tailwind everyone keeps talking about — A global reshuffle of trust and capability.

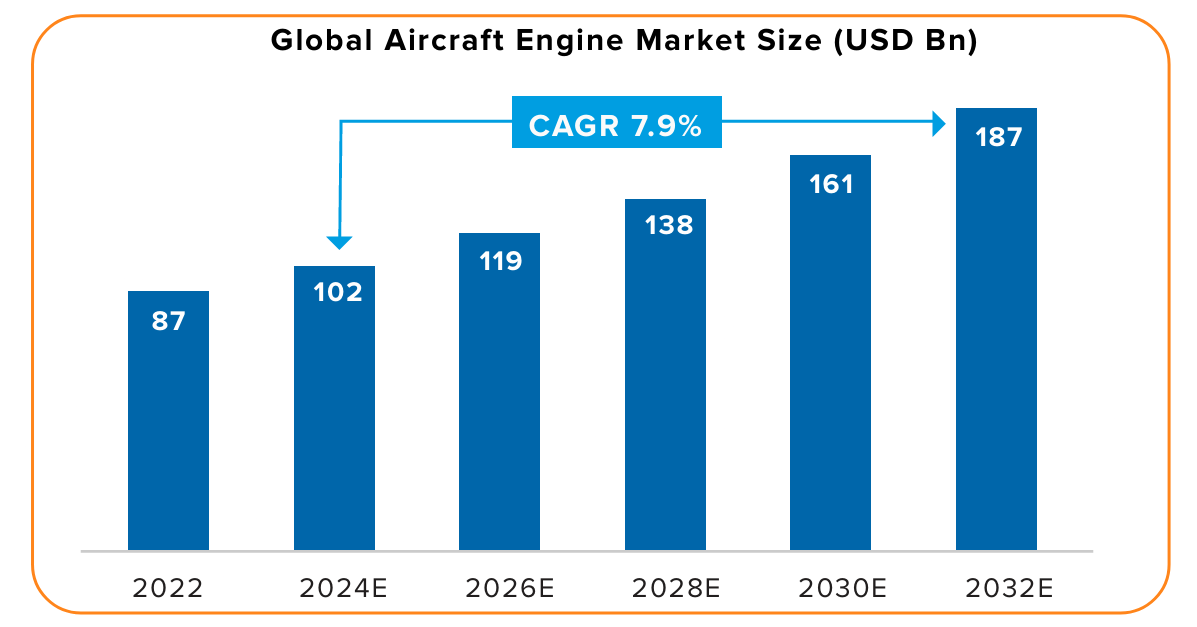

II. The Big Picture: How Fast Is Aerospace Really Growing?

Alright, we’ve talked about the chaos and the rebuild.

Now let’s put some numbers on this bird.

Because if you’re wondering, “Okay cool story, but how big is this opportunity?” — the short answer is: massive, and the long answer is below.

Global Growth: The Sky Keeps Expanding

The global aerospace manufacturing market today sits at roughly USD 430 billion & is projected to reach USD 530 billion by 2028, clocking a steady 3.6 % CAGR.

That’s not crazy-high like EVs or semis — but remember, this is a sector where production runs last decades, not product cycles.

That’s where technology, certification, and pricing power live — and where Indian players are slowly making their mark.

Airbus and Boeing together have aircraft order backlogs that stretch 10–12 years.

Translation: the runway for component demand is visible and long.

Even if new orders stopped tomorrow, OEMs and their suppliers would stay busy through the next decade.

India’s TAM: From Vendor to Value-Creator

Now let’s bring the lens closer to home. India’s aerospace play is still small in absolute numbers — but the runway ahead is ridiculous.

Here’s what’s driving it:

Rising domestic demand – India is now the world’s 3rd-largest civil-aviation market. Air India and IndiGo together have over 1,000 aircraft on order, meaning the local ecosystem will need to handle maintenance, parts, and tooling worth billions over time.

Tier 2/3/4 opportunity – This is the sweet spot. Post-COVID exits of many Western precision suppliers left open pockets in aerostructures, engine components, and MRO tooling. These are high-margin, IP-protected niches where Indian firms can scale fast once qualified.

MRO (Maintainenance , Repair & Overhaul) localisation – Currently, Indian carriers outsource 90 % + of maintenance to Singapore or the UAE. Even a 25 % repatriation of that work creates a multi-billion-dollar annual market domestically.

Put together, India’s potential addressable opportunity across aerostructures, engines, and MRO tooling easily crosses USD 10–12 billion annually over the next 10-12 years and that’s before factoring exports.

III. Policy & Ecosystem Tailwinds

This isn’t happening in a vacuum. The government’s finally realised that aerospace is more than just fancy defence jets — it’s a strategic manufacturing play.

Make in India & Defence Corridors – Clusters in Tamil Nadu and Uttar Pradesh are designed to host both defence + civil suppliers, with plug-and-play infrastructure, common testing facilities, and land near airfields.

PLI & offset policies – Incentives for advanced manufacturing, precision engineering, and component exports are pulling global Tier-1 names to set up sourcing offices and JVs here.

Global partnerships – Airbus, Boeing, Safran, Collins, Honeywell, GE — all have active tie-ups with Indian firms for machining, composites, and engine parts.

Certification ecosystem maturing – DGCA, HAL, and private firms are investing in AS9100, NADCAP, and OEM-specific approvals - the passports you need to play in this league.

Put it all together:

Demand visibility?✅ 10 years +

Global diversification? ✅Accelerating

Policy support?✅ Finally serious

Indian capability? ✅ Getting sharper every year

The next question is: where exactly do we fit in this massive value chain?

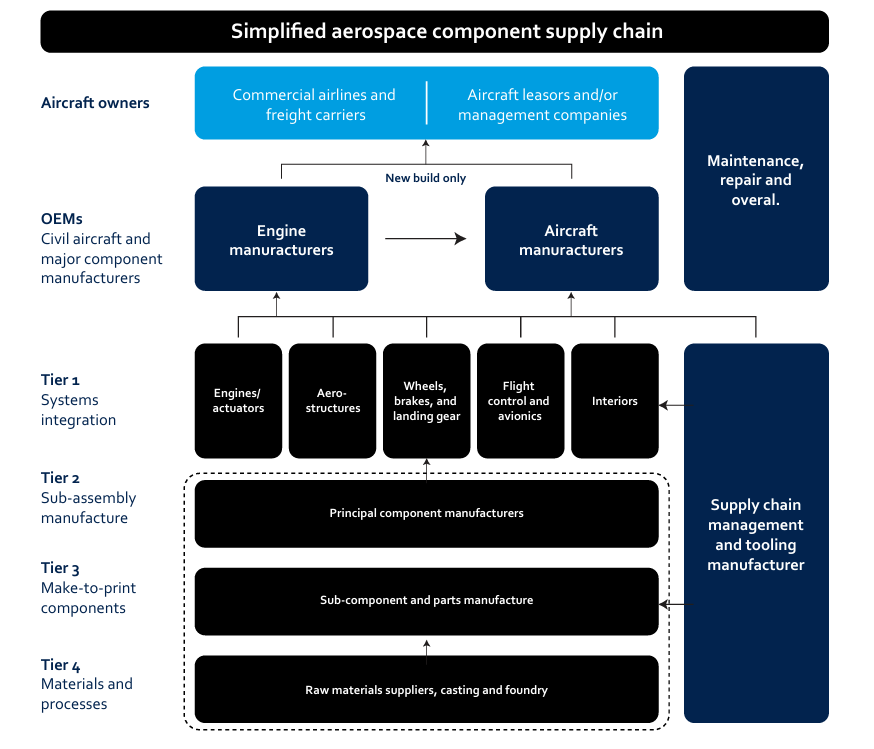

IV. The Aerospace Value Chain: Who Does What (and Why It Matters)

Alright, before we start throwing around “Tier-1, Tier-2, Tier-3” jargon like Experts at a conference, let’s simplify this whole ecosystem.

Think of the aerospace industry like constructing a massive skyscraper. So, who makes what ? Let’s break it down tier by tier.

1️⃣ OEMs : The Master Builders

Examples: Airbus, Boeing, Embraer, Lockheed Martin

These are the final assemblers. They design the aircraft, integrate systems, set safety benchmarks, and deliver the finished plane to airlines.

Analogy: The OEMs are the architects and chief contractors of the skyscraper. They design the entire structure, set the blueprint, and make sure every subcontractor’s work fits perfectly together - but they don’t lay every brick themselves.

OEMs define what the aircraft will do its size, range, weight, fuel efficiency, emissions, and even noise levels. They rely heavily on Tier-1s to supply entire systems (like engines, wings, avionics, landing gear) and coordinate hundreds of smaller suppliers underneath.

2️⃣ Tier-1 : The System Integrators

Examples: Safran, GE, Rolls-Royce, Collins Aerospace, Spirit AeroSystems

These guys are the heavy lifters; they build large, complex systems or sub-assemblies that plug directly into the aircraft engines, landing gear, avionics, flight-control systems the big-ticket stuff.

Analogy: If the OEM is building the skyscraper, Tier-1s are the specialist contractors handling the plumbing, elevators, and HVAC systems. They deliver complete, ready-to-install systems that fit seamlessly into the structure.

Tier-1s have long-term contracts, deep IP, and tight quality control. They also manage the entire chain of Tier-2, Tier-3, and Tier-4 suppliers who deliver smaller components.

Tier-2 : The Sub-Assembly Specialists

Examples: GKN Aerospace, Aequs, Dynamatic Technologies, TAML, LMW

Tier-2 companies manufacture critical sub-assemblies — parts that go inside the big systems. This includes things like turbine blades, compressor casings, precision forgings, or sheet-metal assemblies for wings and fuselages.

Analogy: If Tier-1s install the HVAC system, Tier-2s are the fabricators and metal-frame builders making the ducts, vents, and modular mechanical sections that make those systems work.

This is where India’s presence is rapidly growing because the work requires precision, discipline, and scale, not just cheap labour. Tier-2 players are the bridge between innovation at the top and execution on the floor.

4️⃣ Tier-3 : The Component Makers

Examples: Small-to-mid machining firms, precision-casting companies, tool manufacturers

These are the “make-to-print” players. They work with drawings and blueprints provided by Tier-1 or Tier-2 and deliver exactly what’s specified — nothing more, nothing less.

Analogy: Think of them as the craftsmen and bricklayers — they don’t design the building, but every bolt, bracket, and hinge they make holds the structure together.

They focus on parts like brackets, fasteners, ducts, rings, or actuator housings. Margins are tighter, but once qualified, these suppliers enjoy long-term visibility because OEMs hate changing certified vendors.

5️⃣ Tier-4 : The Material and Process Backbone

Examples: Foundries, forging units, alloy producers, coating and heat-treatment specialists

This is where the raw stuff begins. They provide the metals, composites, and treatments that give aerospace parts their strength, lightness, and heat resistance.

Analogy: If the entire aerospace supply chain is a skyscraper, Tier-4 is the foundation and building material supplier ; invisible but absolutely essential.

India’s growing here too (but slowly) : especially in titanium, aluminium forgings, and advanced machining materials but this layer still needs deeper local ecosystem support.

✈️ So Where Does India Fit Right Now?

India currently sits between Tier-2 and Tier-3, with select companies moving up the ladder. Most domestic players started as “make-to-print” partners (Tier-3) but are now climbing toward design-led, IP-driven manufacturing (Tier-2).

Indian suppliers’ share is small today (~2 %) but target is ~10 % in the near future, which implies a significant ramp-up opportunity.

This is where the real value unlock happens because moving from execution to co-creation with OEMs means higher margins, better visibility, and more pricing power.

And that’s exactly the transition Indian firms are making today one precision component at a time.

In Short ,Think of building a Aircraft like a Skyscraper — The OEM (Airbus, Boeing) is the architect & main contractor who designs the building & brings everything together. The Tier-1 suppliers are the specialist contractors they handle major systems like the elevators, plumbing, and HVAC. The Tier-2 suppliers make the pipes, ducts & steel frames that go into those systems, while Tier-3 suppliers craft the bricks, hinges, & bolts that hold it all up. Finally, the Tier-4 suppliers provide the raw materials the cement, steel, and coatings.

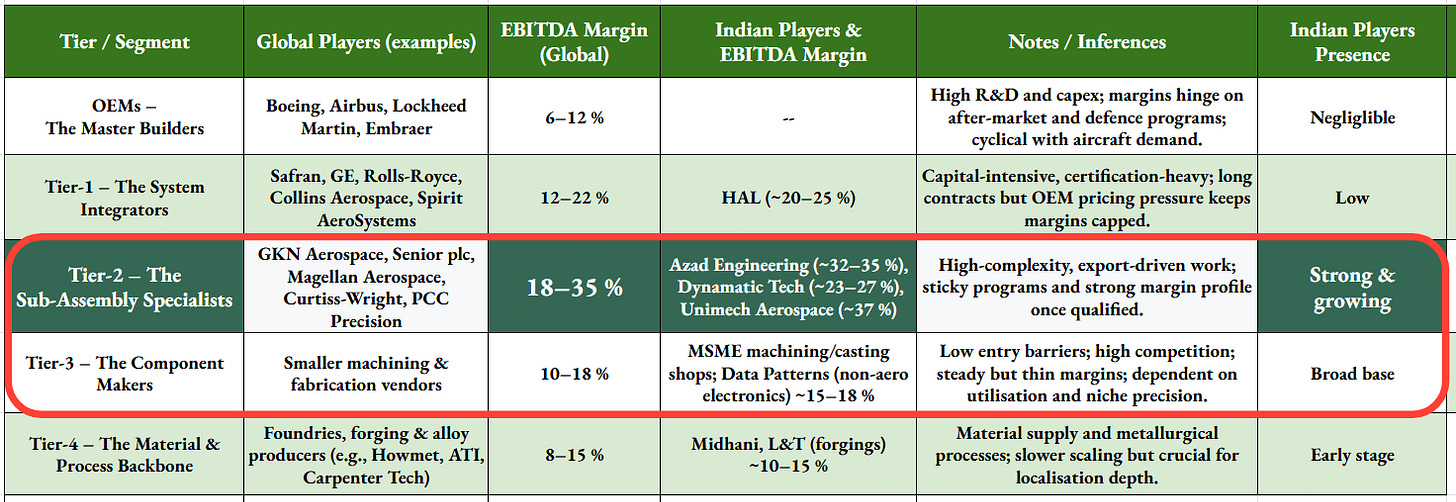

V. The Aerospace Value Chain — Who Makes Money Where

Before we talk stock names or moats, it’s worth pausing and seeing where the real money sits in this ecosystem. Because not every layer of the aerospace pyramid earns the same - some build scale, others build moats.

Key things to note before you start :

Margins expand as complexity and IP ownership increase.

The real profitability sits between Tier-2 and Tier-1, where precision, certification, and reliability meet.

OEMs look glamorous, but high R&D and working capital needs compress their returns.

Tier-3 and Tier-4 vendors are stable feeders, but they live on volume, not pricing power.

Here’s a quick breakdown of the margin stack across tiers 👇

In aerospace, the higher you climb up the value chain (Tier 2) , the thicker your moat and the fatter your margin.

For those tracking the space, Here’s a quick list of Indian names currently operating in Aerospace ecosystem : Raymond Ltd , Unimech Aerospace , Azad Engineering, Dynamatic Tech, Rangsons Aerospace(unlisted), Tata advanced systems (unlisted)Long story short : What Should You Infer?

The sweet spot for India is clearly Tier-2/Tier 3, where margins (20–35%) meet capability. These firms sit at the intersection of complexity + scalability making them long-term compounders if they execute well. As India climbs up the value chain, every step upward adds certification moat, pricing power, and stickier client relationships.

I’m building something quietly behind the scenes.

Can’t say much yet not ready to share the details or what exactly it is. Just know that it’s something big, something I’m deeply excited about.

A space. A community. A shift.

For now, I’m keeping it under wraps. But If you’re interested in joining the early mentorship , just drop me a mail at — thelogicalinvestor.business@gmail.com or message directly.

That’s all for now. More soon - when the time’s right.

VI. The Turbulence: Risks & Challenges in India’s Aerospace Story

Let’s be honest no runway is ever perfectly smooth.

The aerospace sector looks exciting on paper: long visibility, export tailwinds, global diversification. But before you start putting every “precision” company in your watchlist, let’s talk about the headwinds no one talks about.

Because this industry, for all its glamour, runs on discipline, patience, and painful timelines.

🧾 1️⃣ Certification : The Biggest Entry Barrier

In aerospace, you don’t sell : you get qualified.

Getting a part approved by Boeing, Airbus, or Rolls-Royce isn’t a procurement process it’s a multi-year audit.

Each component must pass AS9100, NADCAP, and multiple customer-specific certifications. Even a minor process deviation can mean starting from scratch.

And once qualified? Great , but scaling up means fresh audits, new documentation, and more money stuck in working capital.

In short: It’s not a business you can “hustle” your way into.

You either follow every process perfectly or you’re out.

From first RFQ to stable cash flow? Easily 3–5 years.

This is not your auto-ancillary-style “new order every quarter” business.

Once you win a program, it’s sticky ; but getting there takes time, precision, and trust.

This also means revenues are lumpy, and growth visibility can be misleading unless you track program-level ramp-ups.

2️⃣ Capital Intensity & Working Capital Lock

Setting up a fully certified machining or surface-treatment facility costs ₹50–100 crore+ depending on complexity.

Add tooling, process validation, and customer audits — and your cash is tied up for years before steady revenue begins.

Payment cycles are also long OEMs and Tier-1s typically pay 90–120 days post-delivery. And if you’re working for a new program, expect delays before full-volume production kicks in.

So yes, great margins ; but only after you’ve survived the capital grind.

3️⃣ Global Cyclicality & Geopolitical Exposure

Airlines, OEMs, and defence budgets move in cycles.

A global slowdown, war, or supply chain shock can stall new aircraft orders for years.

Plus, aerospace components are export-heavy, so forex swings, trade restrictions, or even a single sanctions issue can ripple through the entire value chain. India’s “China+1” story helps, but let’s be clear this is a global business with global shocks.

4️⃣ Talent & Skill Gap

Aerospace machining isn’t like automotive. One wrong cut, and the part is scrap often worth lakhs. India’s labour cost advantage is real, but the skill gap in precision machining, heat treatment, and documentation discipline still limits scalability.

Training a machinist to aerospace standards can take 2–3 years.

And attrition? It hurts.

Companies are now investing in in-house training schools just to maintain workforce depth.

5️⃣ Supply Chain Dependencies

Even today, most Indian players import aerospace-grade titanium, aluminium, and coatings. Until the local Tier-4 ecosystem matures, cost volatility and import dependence will stay a drag.

Government initiatives like Defence Corridors and PLI for aerospace & drones will help but self-reliance takes time.

🧠 The Other Side of the Runway

Aerospace is not for the impatient. Timelines are long, returns come slower, but stickier once they arrive.

Capital and certification are the two walls every new entrant must climb - there’s no shortcut. Skill, quality, and documentation discipline matter more than cost advantage.

Short-term investors will get frustrated; long-term operators will quietly build empires.

Everyone wants to fly high — few realise how long the runway really is.

VII. How to Think Rationally About the Aerospace Boom

If you’ve made it this far — congrats.

You’ve just navigated a full flight through supply chains, value chains(OEMs → Tier-1 → Tier-2 → Tier-3 → Tier-4), and margin chains and honestly, your brain deserves a landing clearance. 🛬

Now, before we start attaching “Multibagger” to every company that owns a CNC machine, let’s talk about how to actually think about this theme.

Because this sector is exciting yes. But excitement without context is just turbulence.

1. Limited Players, Not a Crowded Party

This isn’t a typical “sectoral rally” where dozens of names run together.

In the listed space, India has barely a handful of serious aerospace suppliers —

mostly Tier-2 and Tier-3 vendors, quietly machining parts for global programs while others tweet about “defence exposure.”

Lesson: In aerospace, the real moat is built, not bought.Your job as an investor?

Read each one thoroughly.

Understand their customer mix, certifications, and execution history —

because this is an industry where you earn credibility micrometer by micrometer.

Forget the “theme investing” noise.

This is pure bottom-up territory. Treat each company like a business, not a label.

2. The Opportunity Is Massive : But It’s a Marathon

The total addressable opportunity?

Around $20–30 billion annually, with visibility for the next 10–15 years.

Global OEMs and Tier-1s need new, trusted suppliers.

India, with its cost efficiency and geopolitical neutrality, fits the brief perfectly.

But don’t expect fireworks every quarter this is slow compounding in its purest form.

Each certification, each delivery, each client relationship all stack up gradually.

Reality check: Aerospace isn’t about “next quarter growth.”

It’s about the next decade of credibility.Once you’re qualified and trusted, the contracts stick.

That’s when the flywheel starts humming.

3. Concentrated Sector = Stronger Moats

The very reasons aerospace grows slowly ; high entry barriers, certification costs, long gestation cycles are exactly why it becomes powerful once you’re in.

There won’t be 100 aerospace companies.

There’ll be 10–15 serious ones. And that’s good news.

Few players. Long programs.

Deep relationships. Sticky margins.

That’s how quiet compounding looks in manufacturing.

It’s not a gold rush. It’s a gated community.4. Valuations : Look Beyond the P/E Myopia

You’ll see high P/Es across the board.

And yes, they’ll look scary at first glance.

But this isn’t FMCG or retail banking — these are early-stage compounders sitting on the runway of a multi-decade upcycle.

When a ₹500 crore business compounds at 20–25% in a niche where only a few players operate, the earnings catch up faster than you think.

The market isn’t just pricing earnings. It’s pricing rarity.Valuations look rich only until scale hits and when it does, the “expensive” stock quietly becomes the “obvious” one five years later.

5. The X-Factor : Back the Right Promoter

In aerospace, you’re not betting on the order book — you’re betting on the operator.

This game needs a founder who can:

Handle global audits without breaking a sweat.

Navigate documentation thicker than your CA’s annual report.

Reinvest patiently and keep composure when a shipment gets rejected for surface roughness.

Mindset > Machinery.

Process > Pitch decks.The best promoters here are builders, not storytellers. They won’t talk about “defence exposure” on CNBC they’ll quietly spend two years getting one global client certified.

That’s where wealth is created ; not in drama, but in discipline.

🧩 The Bigger Picture

Everyone’s chasing the next multibagger. Smart investors are quietly studying the next moat. Ultimately, this sector will reward those with:

Patience (lots of it)

Conviction in capability

And belief in execution over excitement

Because in aerospace: The loudest players chase headlines.

The real ones chase tolerances.So stay curious, keep learning, and watch the runway carefully.

Because when this sector finally takes off, you’ll want to be on board not still waiting at the terminal. 🛫

Ultimately, whether this sector is an investable opportunity depends on your risk appetite, patience, and belief in the team’s ability to execute.

Happy investing!

📩 Subscribe for more deep-dive insights.

Found Value in This Sectoral Breakdown ?

Researching a new sector isn’t easy. It takes time, patience, and a lot of reading between the lines.

People are charging thousands for sectoral webinars, “exclusive investor meets,” and Research reports on exactly this kind of content.

Here, you’re getting it raw deep-dive research, simplified for real investors who want to understand before they act.

Every edition like this especially sectoral deep dives comes after days (and often weeks) of going through policy documents, government tenders, Sectoral reports, industry whitepapers, con-calls, and company filings.

The goal is simple: to break down complex sectors like Aerospace into clear, digestible insights that actually help investors think independently not just follow the noise.

While others hide behind paywalls or pitch paid “masterclasses,” this newsletter stays open , independent and continues to deliver high-quality, in-depth research for free, directly to your inbox. No paywalls, no fluff - just real work, shared with genuine intent.

If you’ve found value in this sectoral breakdown — if it helped you connect the dots, see where opportunities lie, or simply learn something new consider supporting the work.

A small contribution of ₹399 / ₹499 / ₹599 (whatever you feel this edition was worth) helps keep the research independent and ad-free. You can support via PhonePe / BuyMeACoffee using the QR code below.

And if you’d rather not pay — that’s perfectly fine too.

You can still support by sharing this newsletter, reposting threads on X, or simply engaging with the content so it reaches more readers who value genuine, no-noise analysis.

Your support in any form helps keep this kind of research alive, unbiased, and accessible to everyone who wants to understand India’s evolving industrial story.

Thank you for reading, learning, and growing together. ✌️

The Logical Investor

Don’t forget to click the ❤️ button to help others discover it on Substack ! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

With Love & optimism,

A View-Point from Investor’s Lens 🧐

See you next time, Happy investing!

Sources

1. Valuequest Report on Aerospace sector

2. Management Interview, Industry Research Reports , sectoral notes

3. This newsletter is Written based on data as per oct 2025. Consider crosschecking data.

Good work. I've read about the sector and I must say you've covered all important topics. However I think Dynamatic Tech in Tier 1 supplier & not tier 2 - it supplies directly to Boeing, Airbus, Bell, Dassault, etc.

Very in-depth and insightful…. Very helpful . Liked the entire report!!