RBZ Jewellers: Expanding Horizons in India’s Booming B2B Jewellery Industry

#01 Highlights: This company aims to achieve ₹1,000 crore in revenue by FY27, supported by a fivefold increase in production capacity planned for FY26, positioning the company for long-term growth.

Unlocking Growth Potential with RBZ Jewellers in the Organized B2B Jewelry market

Disclosure : Invested & Biased

Industry Overview

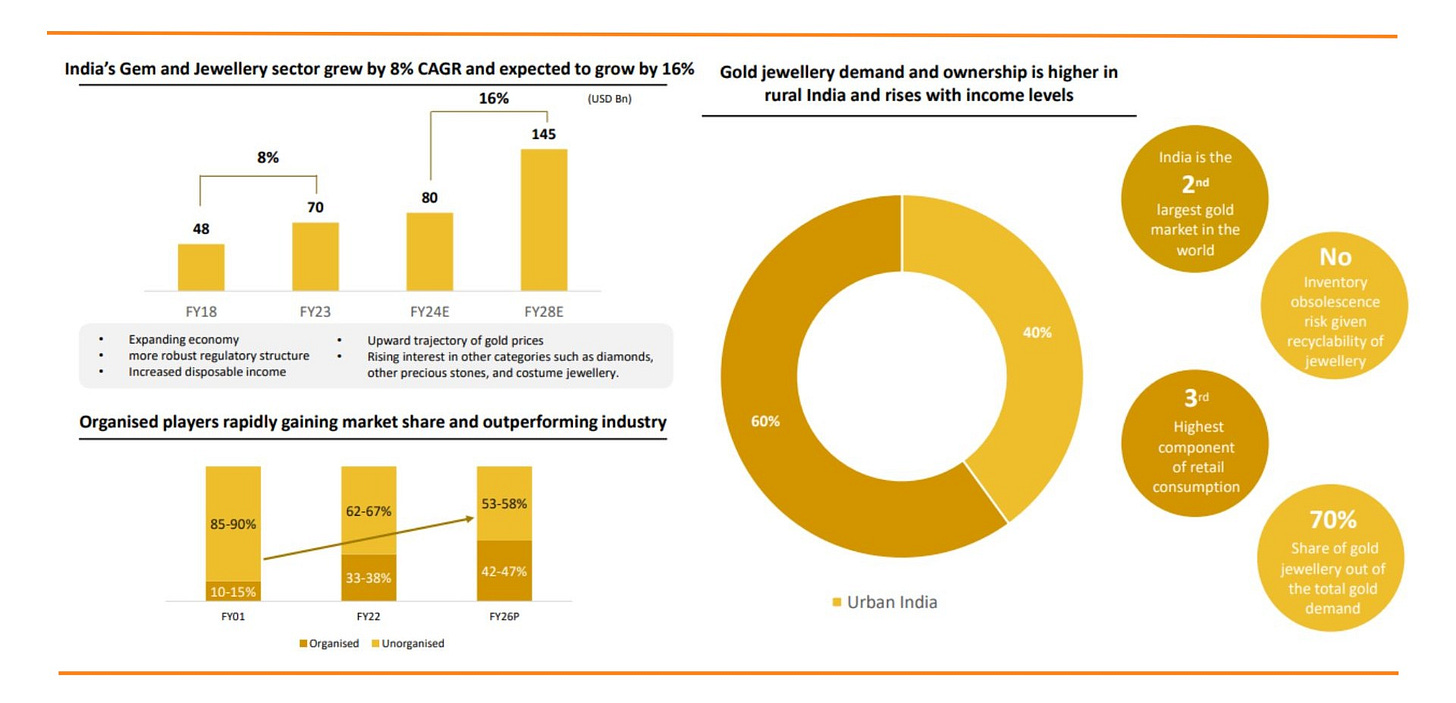

The Indian branded retail Jewelry market is on a robust growth trajectory, with a current market size of approximately USD 80 billion. The sector has been growing at a consistent 8% CAGR and is expected to accelerate to a 16% CAGR in the near future, reaching USD 145 billion, fueled by a growing economy and regulatory reforms. The organized retail sector is poised to capture a larger market share, driven by increased consumer awareness of brands & rising middle class with higher disposable income.

Here are some key trends and statistics --:)

1️⃣ Market Size: India is the second-largest gold consumer globally, with jewelry accounting for 70% of total gold demand. The demand for gold jewelry is further segmented by bridal jewelry (50-55%) and daily wear (35-40%), with a rising trend in lighter, fashion-forward pieces.

2️⃣ Organised vs Unorganised Sector : The share of Organised retail in the jewelry market is expected to reach 40%-50% by 2026, up from just 5%-10% in 2000. This shift is driven by consumer preference for branded, transparent, quality-assured jewellery offerings , bolstered by the rise of digital channels and improved customer service.

3️⃣ Increasing market share in B2B category : As the number of stores in Organised retail chains increases, the demand for established B2B players to manage inventory will rise, creating a significant opportunity for Wholesale players.

South India contributes the largest share (40%) to the Indian Jewellery market, followed by West (25%), North (20%), and East (15%).

About RBZ Jewellers

Incorporated in 2008, RBZ Jewellers Limited operates across the entire jewellery value chain, from sourcing raw materials to selling finished products. The company’s primary focus is on Antique bridal gold jewelry, specializing in traditional Indian designs and craftsmanship techniques such as Jadau, Meena & Kundan work. RBZ follows a two-pronged business model:

1️⃣ Sale of Goods

Wholesale (B2B): RBZ supplies jewellery to a wide network of retailers across India, including well-known names like Titan, Malabar, and Joyalukkas.

Retail (B2C): RBZ operates a flagship showroom "Harit Zaveri" (11,600 Sq. feet) in Ahmedabad, where it sells a variety of gold, diamond, & Polki jewellery directly to consumers. This approach helps the company build strong brand loyalty.

2️⃣ Sale of Services (Jobwork) : RBZ also provides manufacturing services to large organized retailers, creating jewellery using gold supplied by these clients. The company charges for its craftsmanship but does not include the gold value in its revenue. This B2B service adds an important dimension to RBZ’s operations.

Clientile : Titan, Malabar, Joyalukkas, Bhima Jewellers, Senco Gold & Diamonds, Kalamandir & P N Gadgil ( in West India). RBZ also collaborates with numerous other national, regional, and local family retailers across 72 cities in India.

KPIs to track growth

1️⃣ Inventory Days: Tracking inventory days (Currently 193 days) helps understand how efficiently the company is managing its inventory. High inventory days could indicate slow-moving stock and potential inventory write-offs.

2️⃣ Cost of Goods Sold (COGS): COGS as a percentage of sales provides insights into the company's profitability and cost management efficiency. Changes in COGS should be monitored in relation to gold prices.

3️⃣ Volume Increase : This KPI reflects the growth in the company's core business. Tracking volume growth in kilograms of gold processed and sold provides a better understanding of the underlying business momentum.

4️⃣Working Capital Management: Tracking debtor turnover and creditor days are important for assessing the company's working capital efficiency. Strong working capital management is crucial for a business with significant inventory.

5️⃣Sales Mix: Analysing the sales mix between the sale of goods and services highlights the changing dynamics of the business. This information helps in understanding the company's revenue drivers and growth strategy.

Future Outlook

1️⃣ Production Capacity Expansion: RBZ Jewellers plans to increase its production capacity by 5 times its current capacity of 1,700 to 2,000 kgs of gold per year. This expansion is anticipated to be operational in FY26. The company has already begun the process of identifying land and planning the construction of the new facility, which will span over 1 lakh square feet.

2️⃣ Deeper Market Penetration: RBZ is focused on increasing its business share with existing clients by offering a broader product mix and customized solutions to cater to specific market demands. The company aims to secure a larger share of the business from organized retailers, particularly those expanding through IPOs, which will drive demand for wholesale jewellery.

3️⃣ Management Guidance for Revenue and EBITDA Margins: Management targets revenue of INR 500-600 crore for FY25 with a Profit After Tax (PAT) of INR 35 crore, INR 800 crore for FY26, and at least INR 1,000 crore for FY27. They also expect EBITDA margins to grow in line with an expanded capital base, with an estimated profit of INR 20 crore from a balance sheet size of INR 200 crore.

4️⃣ Volume Growth Guidance : RBZ aims to sell 1,300 kgs of gold in FY25, having achieved ~542 kgs in H1, with 758 kgs to be sold in H2. Retail and wholesale saw a 25%-30% growth, contributing 260 kgs in H1. Their flagship store, "Harit Zaveri" in Ahmedabad, is projected to reach ₹250 crore revenue in FY25, reflecting 35%-40% growth. Additionally, the company is expanding by adding 3,000 sq. ft. of floor space, expected to operational in Q3 FY25.

5️⃣ Custom Duty Impact: The reduction in gold import duties has lowered gold prices, affecting inventory valuation. However, RBZ's use of a weighted average cost method helps mitigate this impact. The company believes the long-term benefits of lower prices will outweigh short-term adjustments, as it is likely to drive higher demand.

Risks/ Challenges

Volume Guidance Adjustments: Management initially set a target of 1,600-1,650 kgs of gold volume for FY25, compared to around 1,100 kgs in FY24. However, the target was later revised to 1,400-1,500 kgs and now further reduced to 1,350 kgs for the full year, citing increased gold prices as a key factor, leading to potential degrowth in volumes.

Gold Price Volatility & Competition: Gold prices fluctuate due to global economic conditions, geopolitical events, and investor sentiment, impacting profitability.

Changing Consumer Preferences: Evolving consumer preferences for jewelry styles require constant adaptation. Failing to stay ahead of trends can lead to inventory obsolescence and declining sales.

Conclusion:

In conclusion, RBZ Jewellers is well-positioned to capitalize on the growth of India's organised jewellery market. With its strong B2B focus, established relationships with major national retailers, and a multi-generational legacy, the company has a solid foundation for future expansion. Company is dedicated to investing in both advanced machinery and a skilled workforce as part of its growth strategy. Their ongoing capacity enhancement plan, aimed at increasing production fivefold, further strengthens their ability to meet growing demand.

Being a Small cap company with market cap < 1000 Cr, Execution will be the key, as only consistent delivery on the stated targets will instill confidence & drive meaningful progress.

Ultimately, the best investment depends on your risk tolerance, return expectations, and alignment with each company's strategic focus. Happy investing!

With Love & optimism,

A View-Point from Investor’s Lens

If you found this article helpful, don’t forget to click the ❤️ button to help others discover it on Substack! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

See you next time, Happy investing!

Sources

1. Latest Financial metrics - Q2FY25 Investor presentation & Earnings Call

2. IPO Note on RBZ Jewelers

3. Source: Technopak Analysis, Secondary Research

Appreciate the nice write up, can you also add about completion from Sky gold that RBZ might face ?

is rising inventory value a problem? Is it just because of the increase in gold price or is there some other factor at play? Inventory value has more than doubled from fy 23 to fy 24. Btw excellent article, one of its kind.