Market wisdoms : Tariffs, Panic & the Noise You Need to Cut Through 🧠

Highlights : Trump's tariff moves spark global market chaos, but as Indian investors, it's crucial to cut through the noise and stay focused.

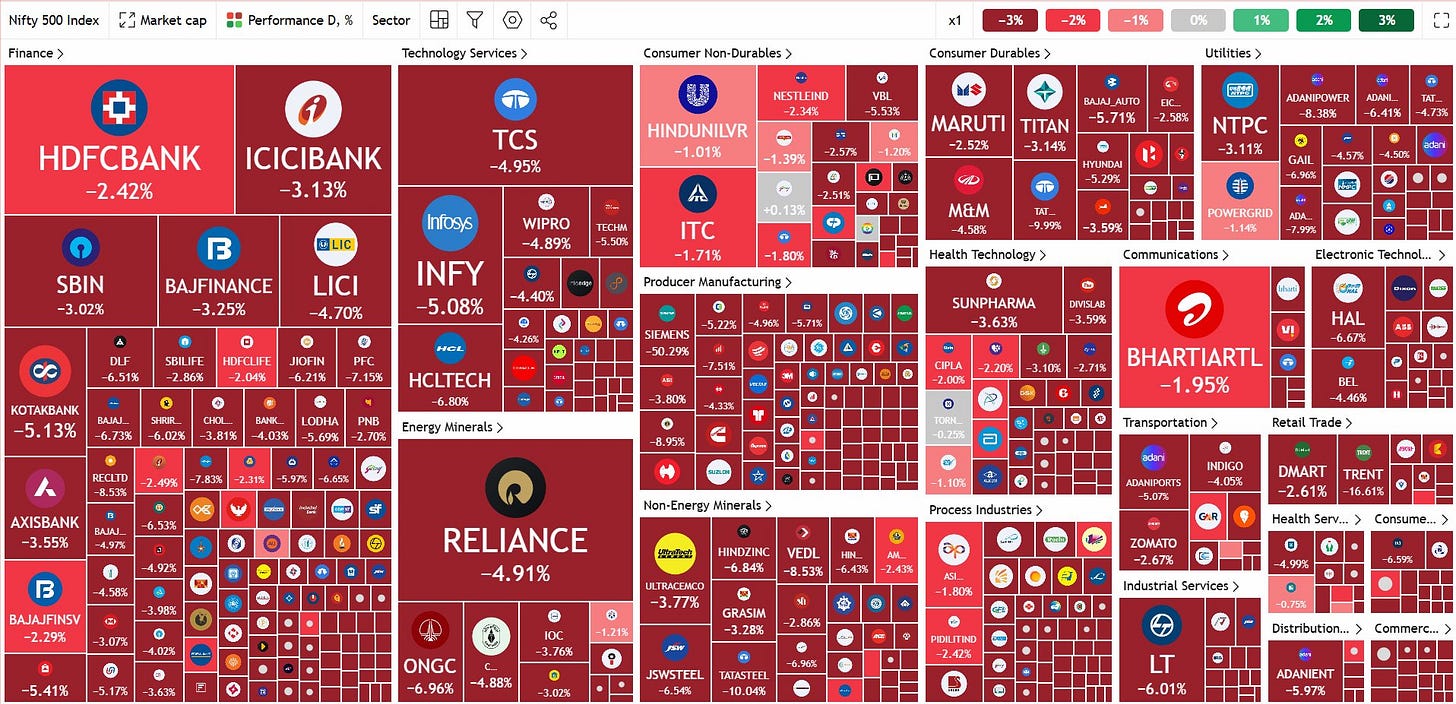

Trump Tariffs Trigger Market Chaos How to think clearly when everything turns red 🔻

A practical investing mindset 🧠

April 2, 2025 — Trump drops tariff bomb again.

Markets worldwide instantly go into "chaos mode."

US indices — red

China — redder

Japan — not spared

🛢 Crude Oil — slumps to $65, near 5-year low

Indian markets — dragged down hard

Everyone’s screaming “What next?” But as Indian investors — where our money is poured in — let’s zoom out and talk like real participants.

Equity Is the Highest Rewarding Asset Class — But at What Cost?

Yes, long-term equity investing can beat most other asset classes. But it ain’t a walk in the park.

Some days, it tests your soul —

Your screen shows red across the board.

Portfolio down 5-10% in a single session.

All because of things you didn’t cause and can’t control — elections, wars, tariffs.

Still want that 15-20% CAGR ?

Then you better learn how to sail through chaos.

So What Should You Do On Days Like These?

Let’s think in probabilities — not panic.

Say, you knew about Trump’s tariffs in advance.

You also knew global markets would bleed.

Now tell me — did you liquidate your entire equity portfolio before the fall?

If yes — congrats.

You are not a human. You're a divine being sent by the market gods.

If not — then what are you even stressing about now?

Big funds Aren’t Panic Selling — Why Are You?

Do you think a Mutual Fund manager handling ₹6000+ Cr

can just go “flip mode” and dump everything?

They know the headlines.

They have more data than all of FinTwitter combined.

Still — no knee-jerk reactions.

So why do you, with a portfolio of ₹5 lakhs or ₹50 lakhs,

think acting on impulse is the way to go?

Cut the Noise. Focus on the Signal.

Not everything is doom & gloom.

Look at what’s actually happening:

✅ Crude at $65 → Big plus for India

✅ Liquidity Surplus in banking system after 4+ months

✅ RBI may cut rates soon

✅ GST collections at all-time high

✅ Exports form a small % of India’s GDP

✅ Markets have consolidated for 6-7 months — that’s healthy

✅ Tariff shifts will create new opportunities — be ready with cash

We can’t control geopolitics. But we can control our mindset.

So chill. Breathe. Let the fog clear.

Two Learnings To Leave You With:

1️⃣ Stay Away From Market Extremists.

You know the type.

“The market will crash to 21000 in wave BC, then reverse to 30,000 in wave A.”

Bro, are you decoding the Mayan calendar or trading Nifty?

Ever seen Ramesh Damani, Ashish Kacholia or Sunil Singhania talk like this?

No.

Because people with real wealth know nobody knows anything.

Don’t get fooled by one correct call. Even a broken clock is right twice a day.

Mute them. Block them.

Focus on real voices sharing data, logic, and sanity.

2️⃣ Manage Your Risk — Don’t Marry Valuations.

You’re holding a stock at 120x P/E,

80% of its revenue is from exports to the US,

and you’re asking “Should I hold or average down?”

Think like an allocator.

Don’t chase hope — chase probabilities.

Ask real questions:

– What’s my exposure?

– What's the business impact of US tariffs?

– What’s the margin of safety now?

Learn to cut noise, not corners.

In Summary:

Yes, the world is chaotic. Yes, Trump can shake things up.

But markets will keep moving.

Opportunities will keep showing up.

Your edge?

Not reacting emotionally.

Thinking clearly in chaos.

Investing like a rational bettor.

This post isn’t to downplay events — it’s to help you level up as a market participant.

No one wins long-term by flipping out every time the wind blows.

Control what you can. Ignore what you can’t.

See the game for what it is — and play it well.

Ultimately, the best investment depends on your risk tolerance, return expectations & alignment with each company's strategic focus.

Let’s grow. 🌱 Happy investing!

Your Support Means the World!

If you have found value in my detailed analysis and insights, and wish to support the effort behind this research, I’d be deeply grateful for any contributions you can make. Your support will help me continue to provide high-quality, in-depth analysis and maintain the quality of work that you’ve come to expect from me.

A contribution of ₹299 or ₹399 would be appreciated to keep the content flowing.

You can Support via PhonePe/ Buymeacoffee using the QR code below(OPTIONAL) :

Don’t forget to click the ❤️ button to help others discover it on Substack ! I’d love to hear your thoughts in the comments—let’s keep the conversation going. For quicker updates, connect with me on X, ID and and Don’t forget to check out the referenced research reports here.

With Love & optimism,

A View-Point from Investor’s Lens 🧐

Note : The post emphasizes psychological resilience amidst market chaos, highlighting the importance of staying calm and not getting swayed by short-term fluctuations. Instead of focusing on numbers, it encourages investors to manage their mindset, avoid panic, and embrace the volatility as part of the long-term journey in equity investing.

If you want to know more about Tariffs :

Read this Post : https://x.com/sahil_vi/status/1907624655399289016

Excellent!